Last year, the RPHI index enabled a

comparison of centre health down

to areas broadly equivalent to

Unitary Authorities (128 areas). This

year, however, we have widened

the index to allow an assessment of

over 2,500 centres.

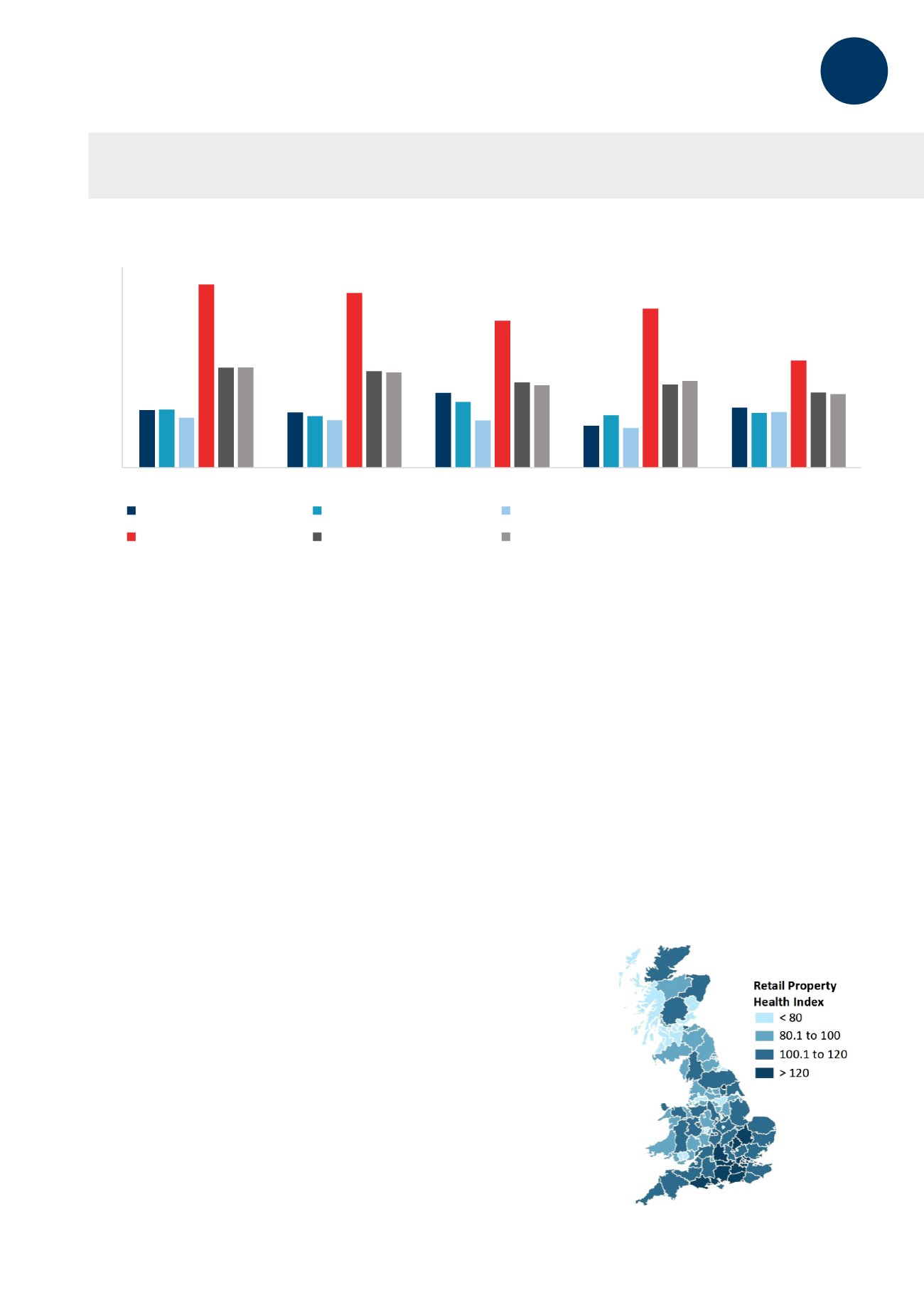

CURRENT RPHI

At a regional level, once again

we have identified London as the

strongest location. This is supported

by an affluent demographic profile,

strong economic fundamentals

and a low vacancy rate. The index

score of 127 compares to the lowest

regional index scores of the North

East and Scotland at 83 – caused

by less affluent shoppers, lower

economic growth over the past

five years and higher than average

vacancy rates. At a more local level,

the top five areas are York, Outer

West London, Oxfordshire, West

Sussex and Milton Keynes. Of retail

centres with over 100 units classed

as comparison retail, the top rated

centres are Witney, Whitstable,

London – Canary Wharf, St Ives –

Cornwall and Hove.

RPHI OUTLOOK

In order to assess the outlook for

retail locations, we have utilised

economic forecasts for the period

2015-2020 to generate an ‘outlook’

index. The ‘outlook economic’

UK index rises from the current

100 benchmark to 115. Although

the rate of population growth is

forecast to fall in the next five years

compared to the previous five

years, unemployment is forecast

to fall to 5% accompanied by

an increased rate of residential

consumer and retail sales growth.

When we use this with the other

RPHI variables, the region with the

greatest growth from the current

final index to outlook index is the

East Midlands; rising from 94 to

103. This region has a relatively

favourable

demographic

mix

along with a faster improvement

in its economic fundamentals than

corresponding regions. The top

five centres in this outlook index

include Witney, Whitstaple, St Ives

– Cornwall, London – Canary Wharf

and London – Clapham Junction.

These centres already exhibit

very low vacancy rates which we

would expect to continue to fall

supporting strong rental growth.

HOTSPOTS

The RPHI outlook index allows us

to identify centres with higher than

average growth prospects but with

current high vacancy levels. The

top five centres with the strongest

RPHI outlook index but with a

vacancy rate index below 75 (100

being average) are Camberley,

Reading,

Newbury,

Chester

and Croydon. These are places

currently experiencing higher than

average vacancy rates, but forecast

to experience above average

economic growth. Stronger than

average economic growth is likely

to erode vacancy rates relatively

quickly and underpin subsequent

rental growth. We would expect

landlords and retailers to closely

assess these centres given their

potential.

7

Retail Therapy

| 2015

0

50

100

150

200

250

300

350

400

450

Witney

Whitstable

London - Canary Wharf

St Ives - Cornwall

Hove

Economic Indexn (current)

Economic Indexn (outlook)

Demographic Index

Vacancy Rate Index

RPHI

Outlook RPHI

Source : Cushman &Wakefield Research

Top 5 ranking

Source : Cushman &Wakefield Research

Current RPHI NUTS 3 Map

“Retail sales have seen 25 months of consecutive monthly year-on-year growth,

the longest period of sustained growth since May 2008.”

UK