The UK remained the most dominant country in terms

of shopping centre acquisitions, with almost €8.2bn

invested in 2014, up from €6.3bn in 2013. Germany and

France also enjoyed a dynamic year with €4.5m and

€3.6m invested respectively.

The European retail sector is likely to continue to

benefit from stronger domestic and investor interest.

Recent research undertaken by Cushman & Wakefield

highlighted an increase in new capital earmarked for

retail investment. Of the single sector funds currently

being raised, close to half (45%) is focused on retail

assets. According to the last Cushman & Wakefield

European Fair Value Index analysis, the retail sector is

now much more attractive than the office sector, with

CEE and Southern European countries offering the

most underpriced markets.

The economic environment is expected to gain

momentum. Consumer spending and retail sales are

anticipated to grow at a moderate pace over the next

four years, which will help the retail sector maintain

its already strong appeal. We forecast that retail

investment will reach €52bn by the end of 2015, with

half of this invested in shopping centres.

The market will continue to be led by strong activity

in the three core markets - UK, Germany and France -

where listed companies are continuing to reshape their

retail and shopping centre portfolios. Additionally,

renewed interest from value added and opportunist

investors, which accounts for close to 46% of newly

raised capital, will lead to increasing investment

volumes in peripheral markets, assuming attractive

pricing continues.

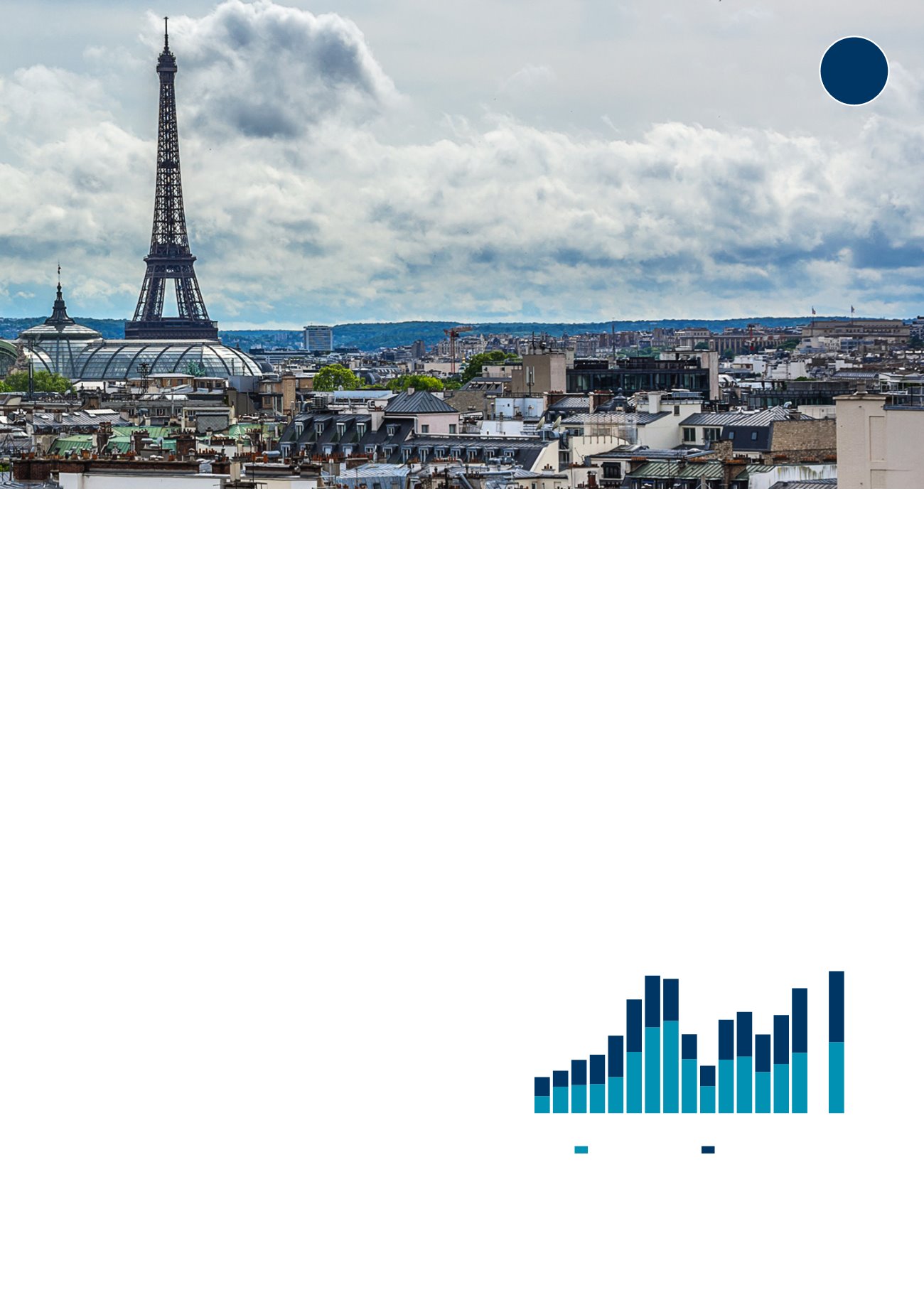

European investment volume in retail sector, EURbn

Source : Cushman &Wakefield Research

Other retail formats

Shopping Centre

-

10

20

30

40

50

60

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015F

5

Retail Therapy

| 2015

“319 shopping centres changed hands in

Europe in 2014, compared to an average

of 196 deals per year over the last

decade.”

EMEA