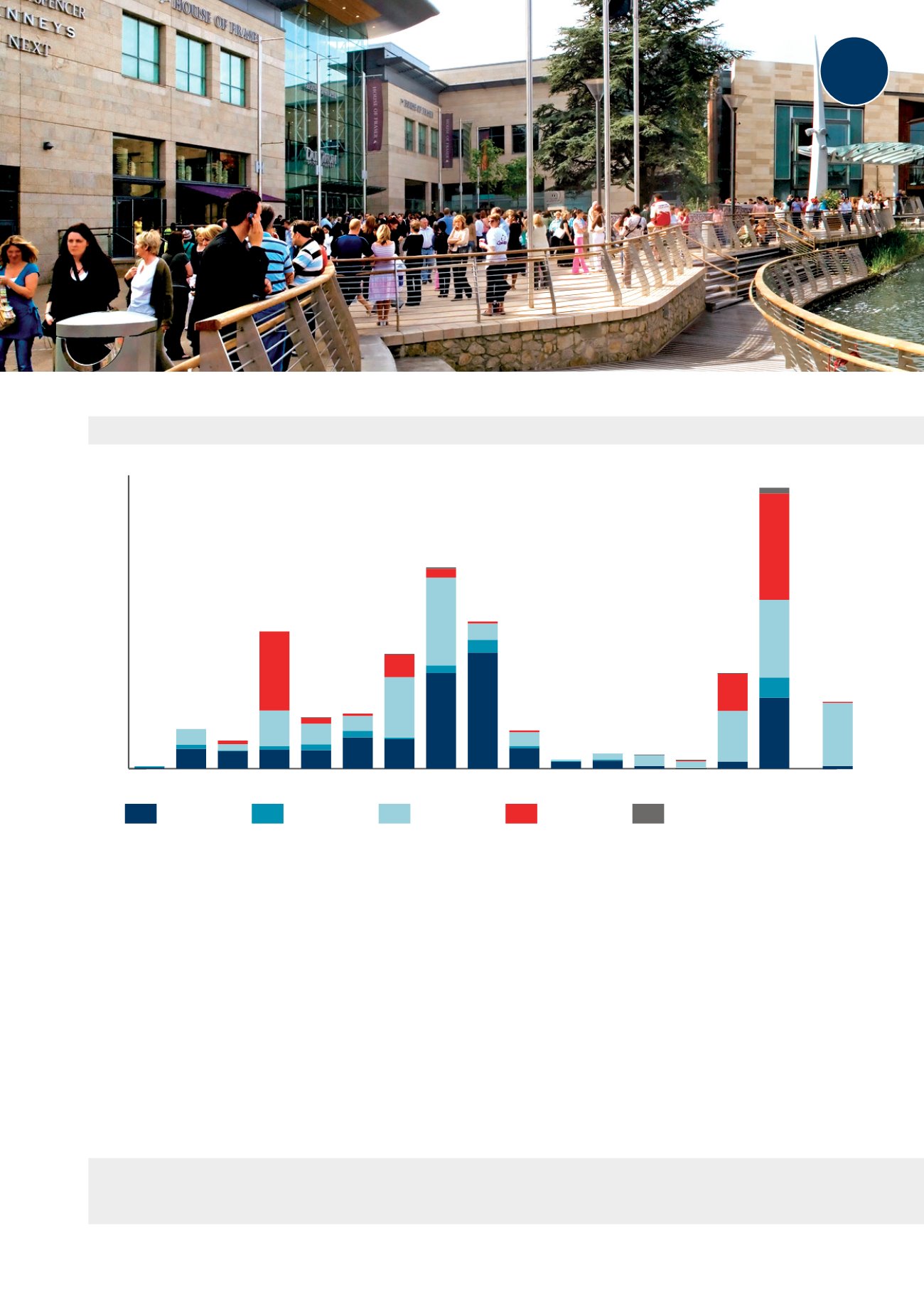

Other/Unknown

Mixed Use

O ce

Industrial

Retail

0

500

1000

1500

2000

2500

3000

3500

4000

Q1 2015

2014

2013

2012

2011

2010

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

1999

Ireland Investment Market, €m

Source : Cushman &Wakefield Research

In contrast, the retail sector is now

seeing strong investment activity

due to an increase in retailer

enquires together with expansion

programmes and a number of

new retailers entering the market.

Retail investment activity in 2014

was boosted by a number of large

transactions including the sale by

Aviva Investors of a majority stake

in the Liffey Valley shopping centre

in Dublin in an off-market sale for a

sum in excess of €250m.

2015 has witnessed further major

assets disposals coming to market

as NAMA unwind their position,

confident that the market appetite

is there and offering investors the

opportunity to acquire prime retail

assets at substantial discounts

compared to similar markets

throughout Europe.

Over the coming year, we expect

to see more foreign investors being

attracted to Ireland’s retail sector

by the rapidly improving economy,

increasing consumer spend and,

more importantly, liquidity.

The old scenario of retail investment

rarely transacting in Ireland has now

disappeared. The new landlords

of retail assets are seasoned and

predominately overseas investors,

and they will look to acquire and

dispose of assets over the coming

years as their investment criteria

demands. Ireland has defiantly

entered a new stage.

11

Retail Therapy

| 2015

“The Irish retail investment market sawmore than €4.5bn of asset sales and over

€22bn of loan sales transacted in 2014.”

Ireland