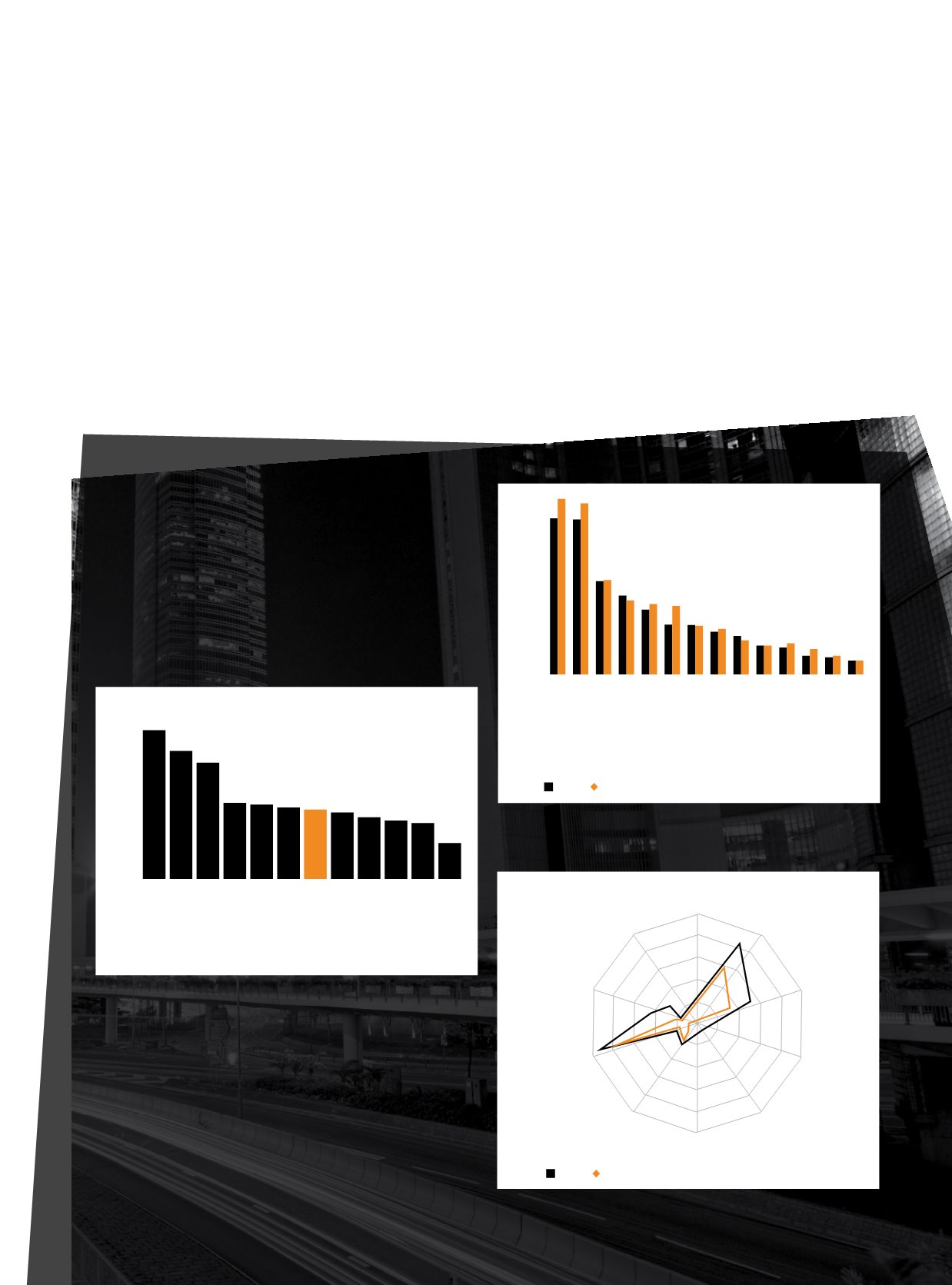

Figure 7: GDP growth 2013-2023 %pa, LCU

Source: Oxford Economics, DTZ Research

0%

2%

4%

6%

8%

China

BRICs

Nigeria

Singapore

South Africa

Hong Kong

Global

Brazil

Australia

Germany

UK

US

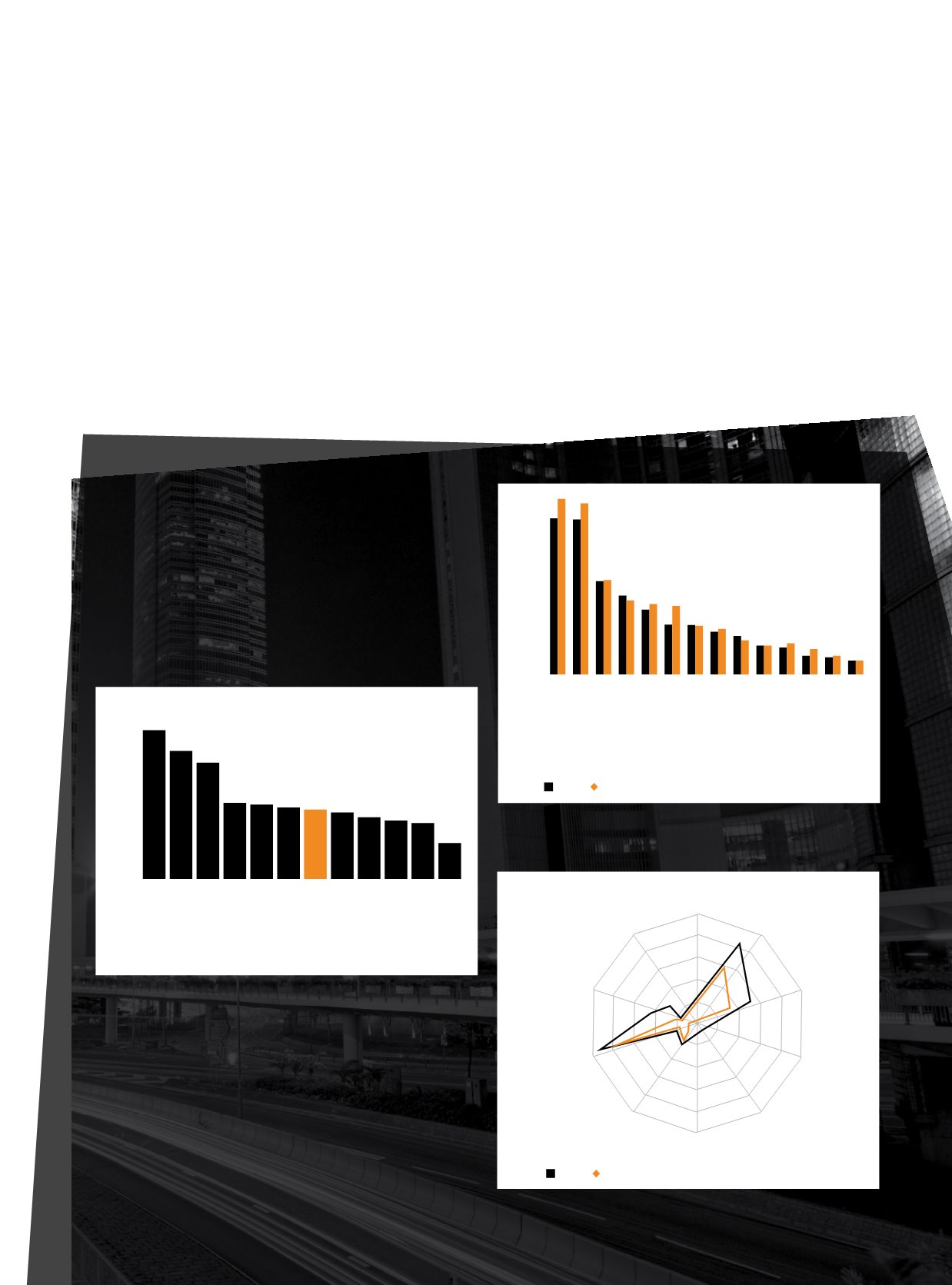

Figure 8: Financial services employment 2013-2023

Source: Oxford Economics, DTZ Research

0

200

400

500

300

100

600

New York

Shanghai

London

Tokyo

Hong Kong

Singapore

Chicago

Sydney

Taipai

Frankfurt

Amsterdam

Zurich

Kuala Lumpur

Paris

2013 2014

Figure 9: Global Risk Index (100= highest risk)

Source: Oxford Economics, DTZ Research

2013 2023

Australia

Brazil

China

Germany

Hong Kong

Japan

Singapore

South Africa

UK

US

4.2.5. Centres of excellence

Banks are increasingly moving towards a ‘centres of

excellence’ model on a regional basis for their back office

and parts of their middle office, a trend that we believe will

continue and accelerate. Using centres of excellence allows

banks some of the same cost savings and economies of

scale of outsourcing, while maintaining some of the benefits

of keeping employee loyalty, knowledge and process

innovation in-house. Typically the type of functions that are

co-located in centres of excellence are not subject to the

rules by which some economies require companies to have

a physical presence in order to operate in that market. These

rules tend to apply to trading and front-office functions.

One of the biggest challenges of outsourcing and off-shoring

is trying to sustain a high calibre labour pool in the long

term. By placing centres of excellence in primary locations

in secondary cities – for example the CBDs of non-capital

cities – banks are ensuring their real estate costs can remain

reasonable while having no problems attracting and retaining

the right talent. Banks must locate themselves wherever

the talent is. We believe that centres of excellence will be a

prime site of innovation through co-location, serendipity and

sharing of best practice, allowing the customer-facing side of

a bank to be at the top of the market.

47

The future of the financial workplace

|

September 2014