96 |

Investor Guide to Europe 2014

The Swiss real estate market is relatively sizable

and sits within the top ten in Europe, alongside

Russia and Sweden. Most activity is centred on the

cities of Geneva and Zurich. Institutions (insurance

companies and pension funds) and unlisted funds

tend to predominate in terms of holdings and

investment activity.

The Swiss real estate market has long been dominated by

domestic investors. However, for several years now, more

international investors are being attracted to the commercial

real estate market, evidenced by increasing activity in recent

years. Swiss law limits foreign acquisitions of residential

properties in order to protect the residential market from

speculation.

Switzerland presents five major submarkets for real estate

investments, namely Zurich, Geneva, Basel, lausanne and

Bern, as well as their respective suburbs.

The safe returns offered by the Swiss market are especially

attractive to core investors, but leveraged investors also find

it valuable for diversification and hedging reasons. Indeed,

total returns of direct investments are characterised by a

low standard deviation, representing a low risk and therefore

comparably low yields.

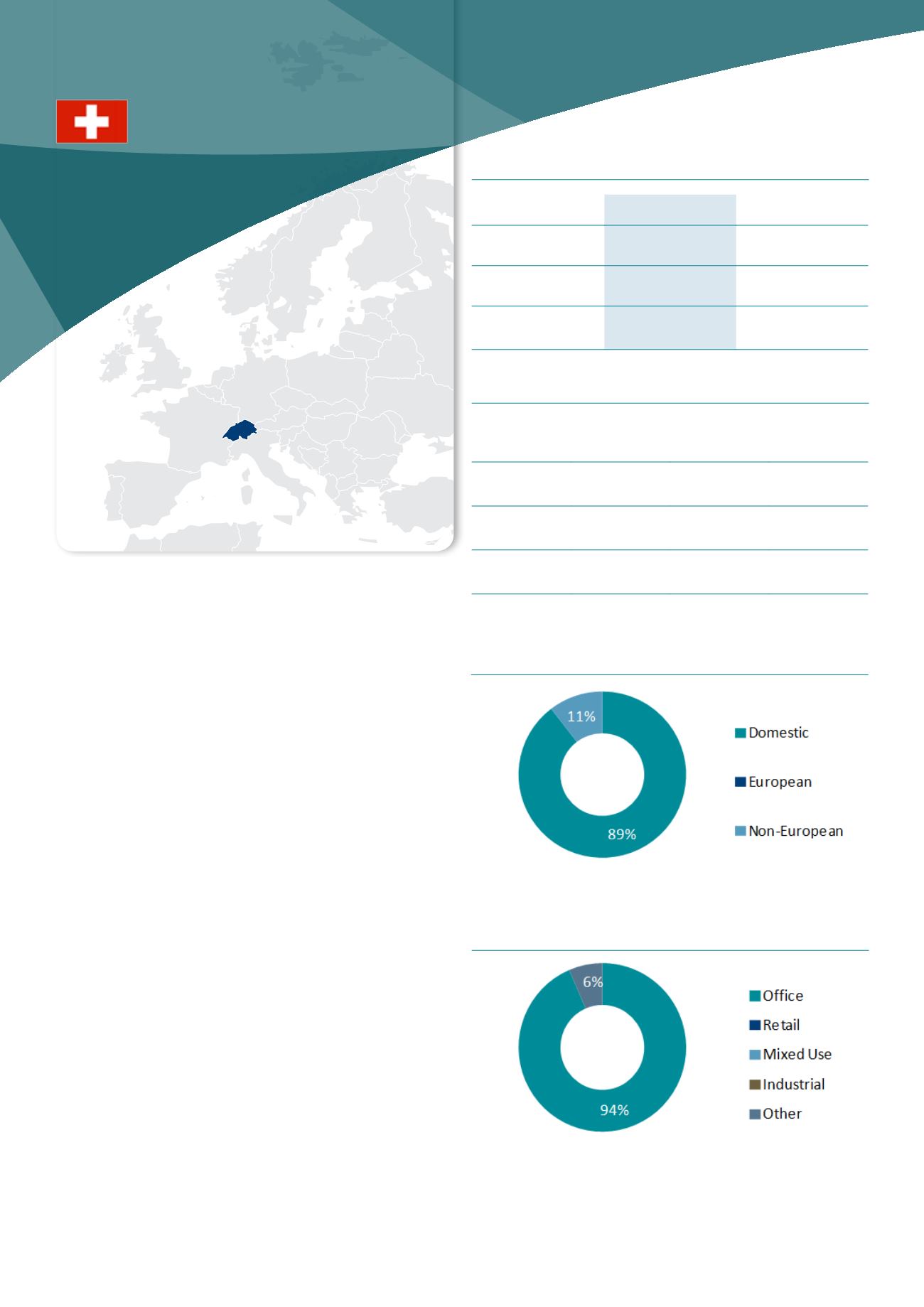

Market sizing

Switzerland

Europe

Invested stock*

(Total stock)

EUR 150bn

(EUR 185bn)

EUR 3,380bn

(EUR 8,150bn)

liquidity ratio*

(10y average)

0.5%

(0.3%)

4.0%

(4.5%)

2013 volumes

(10y average)

EUR 1.0bn

(EUR 0.5bn)

EUR 139bn

(EUR 135bn)

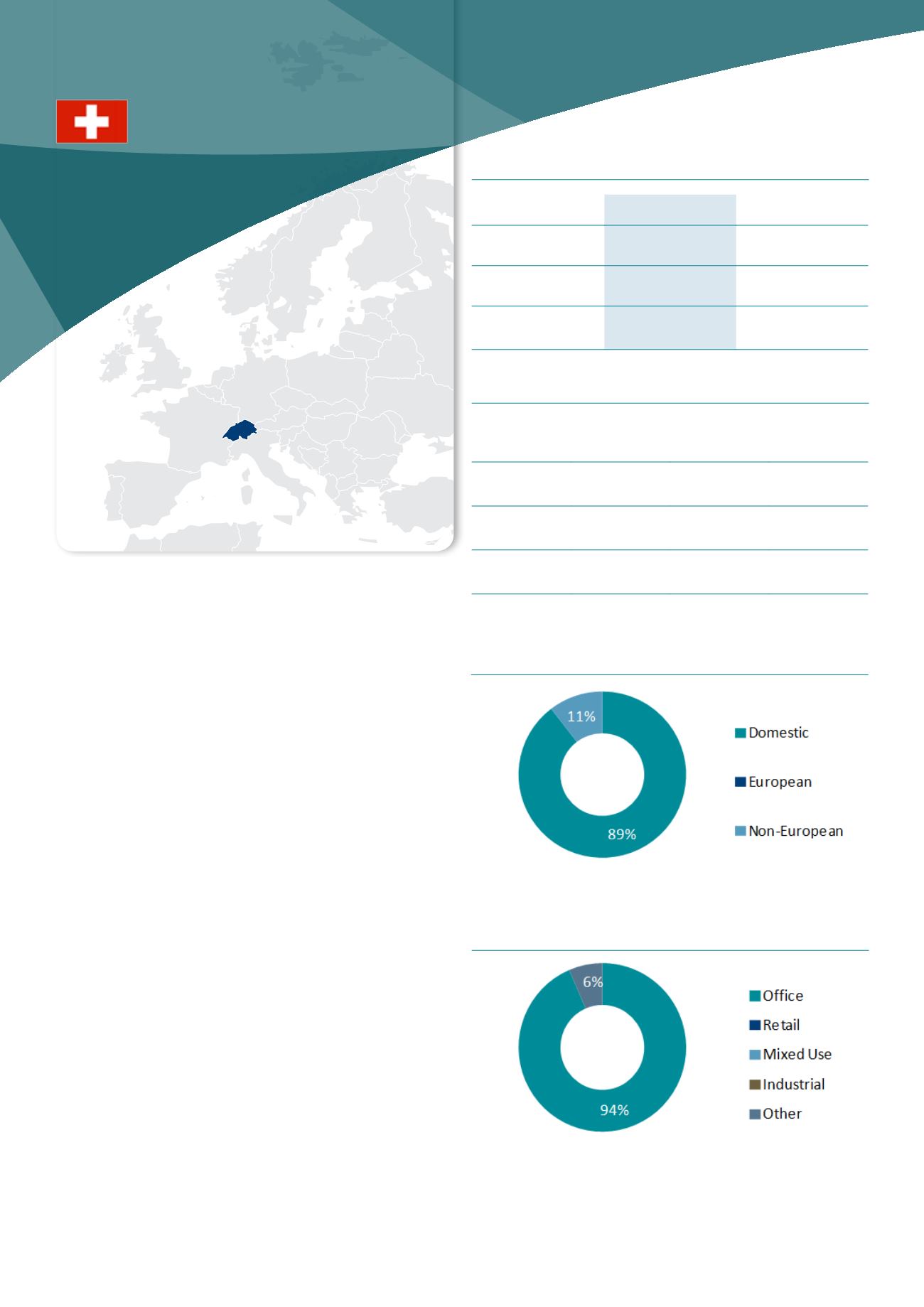

Investment activity by asset type, 2013

Source : DTZ Research

Investment activity by source of capital, 2013

Source : DTZ Research

Market pricing – Geneva (Q4 2013)

office

Retail

Industrial

Current Yield 3.50% 3.50% 6.00%

Min/Max

(10y)

3.50-5.50% 3.50-4.20% 5.75-6.50%

Yield

definition

net initial yield

Source : DTZ Research

SWITZERLanD

* 2012 figures