104 |

Investor Guide to Europe 2014

The ukraine whilst offering the potential of one

of the largest commercial real estate markets in

Central and Eastern Europe has as yet failed to

fulfil this potential despite a number of periods of

active international investment into the market

deriving largely from Western European, Israeli and,

CIS funded sources. It remains one of the smallest

markets by stock in Europe, although liquidity levels

have picked up recently. Political instability in the

country remains an issue.

Since its independence in 1991, Ukraine has attracted

speculative investors, with funds going into both existing

prime assets across all sectors, as well as development

pipeline. This interest in Ukraine has typically followed periods

of political change, following the post independence activity

between 1996-1998 and 2004-2008. Whilst a majority of

interest has been towards the capital city kyiv, international

retail investors and developers have been active within the 6

main regional cities of Ukraine.

Following a severe economic downturn in late 2008-2009,

despite the economy demonstrating for the last 3 years

moderate economic growth from a European comparison,

investor confidence in Ukraine has continued to deteriorate

along with the availability of debt financing driven by the exit

of a number of foreign banks from the country.

Whilst affordable debt remains elusive, this is driving the

need for investors to seek some joint-venture opportunities

particularly for larger schemes. Investment assets presently

placed to market demonstrate a material inverse liquidity

relationship between lot size and liquidity due to the high costs

and low availability of debt finance.

Market sizing

Ukraine

Europe

Invested stock*

(Total stock)

EUR 13bn

(EUR 125bn)

EUR 3,380bn

(EUR 8,150bn)

liquidity ratio*

(10y average)

0.6%

(1.5%)

4.0%

(4.5%)

2013 volumes

(10y average)

EUR 0.1bn

(EUR 0.3bn)

EUR 139bn

(EUR 135bn)

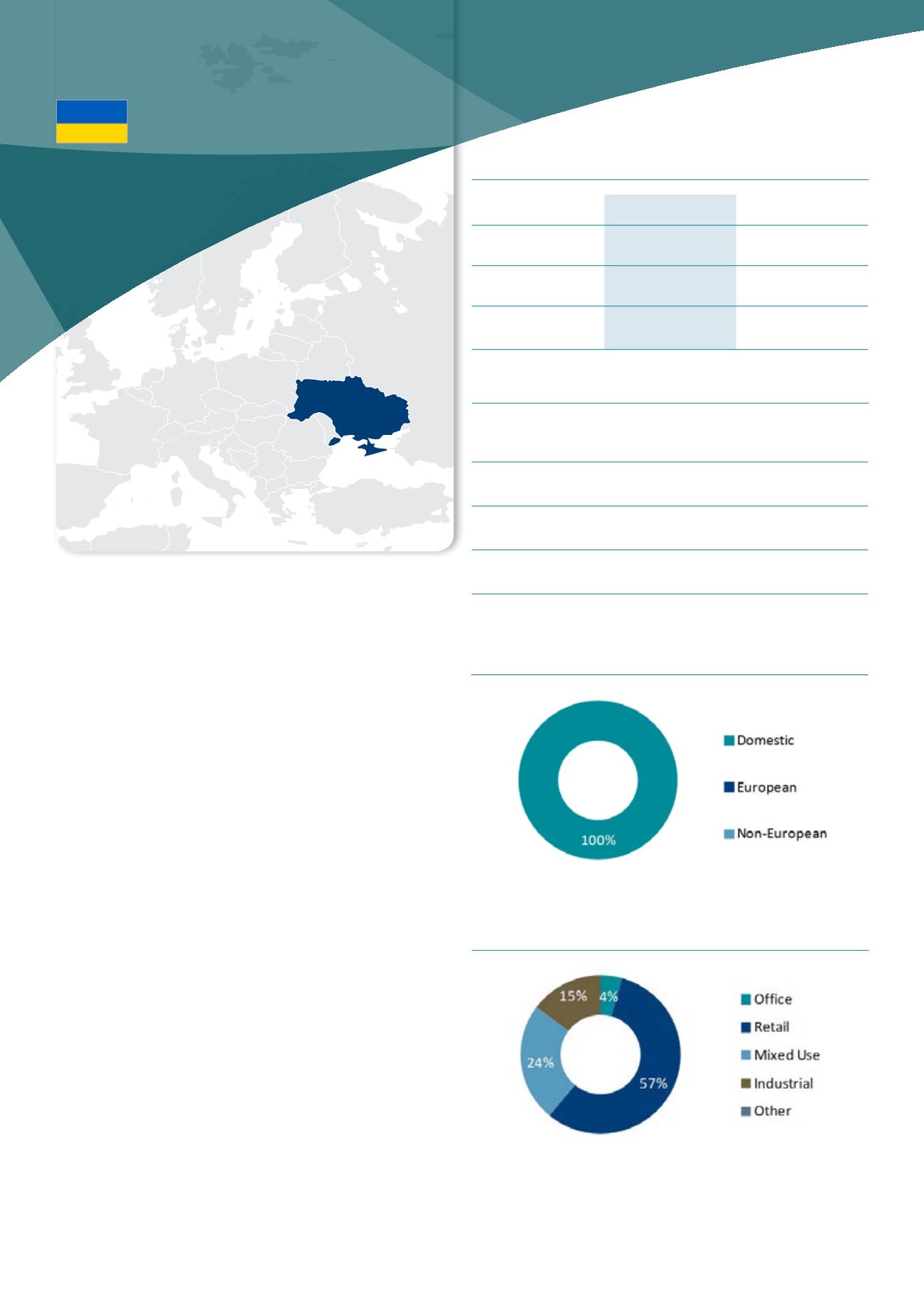

Investment activity by asset type, 2013

Source : DTZ Research

Investment activity by source of capital, 2013

Source : DTZ Research

Market pricing – kyiv (Q4 2013)

office

Retail

Industrial

Current Yield 12.50% 10.00% 15.00%

Min/Max

(10y)

9.20-20.00% 9.60-16.00%

10.00-

30.00%

Yield

definition

net initial yield

Source : DTZ Research

uKRaInE

* 2012 figures