92 |

Investor Guide to Europe 2014

Sweden is the largest of the nordic markets by

stock and the ninth largest market in Europe.

although smaller than the uK, Sweden has had the

highest liquidity ratio over the past ten years and is

the second most liquid market globally.

Investment is not just focussed on the capital Stockholm, but

also across the country, which provides more diversity for

investors. The country has a strong investor base, with many

active institutions and property companies. It also has an

active listed sector, although there are no REITs in Sweden.

Historically the market has seen strong levels of domestic

investment as well as overseas investors, notably from

neighbouring norway and the Uk. There are also a number of

funds active in sourcing capitals from global investors.

Most investors focus on high-quality so-called prime real

estate, especially within the office and retail segments. Foreign

investors concentrate mostly on prime retail and logistics

properties let on long-term contracts. As there is a limited

supply of property for sale in the prime segment, an increasing

number of investors are tapping into the secondary segment.

Although impacted by the financial crisis, Sweden has been

seen as a relative safe haven, and market activity recovered

strongly from a low in 2009. Much of this activity has been

driven by domestic investors.

Swedish banks have also retained healthy balance sheets and

have not been as exposed to under-performing loans. Debt is

readily available, mostly from traditional banks. Institutional

lending remains limited.

Market sizing

Sweden

Europe

Invested stock*

(Total stock)

EUR 120bn

(EUR 165bn)

EUR 3,380bn

(EUR 8,150bn)

liquidity ratio*

(10y average)

6.5%

(9.0%)

4.0%

(4.5%)

2013 volumes

(10y average)

EUR 7.5bn

(EUR 9.0bn)

EUR 139bn

(EUR 135bn)

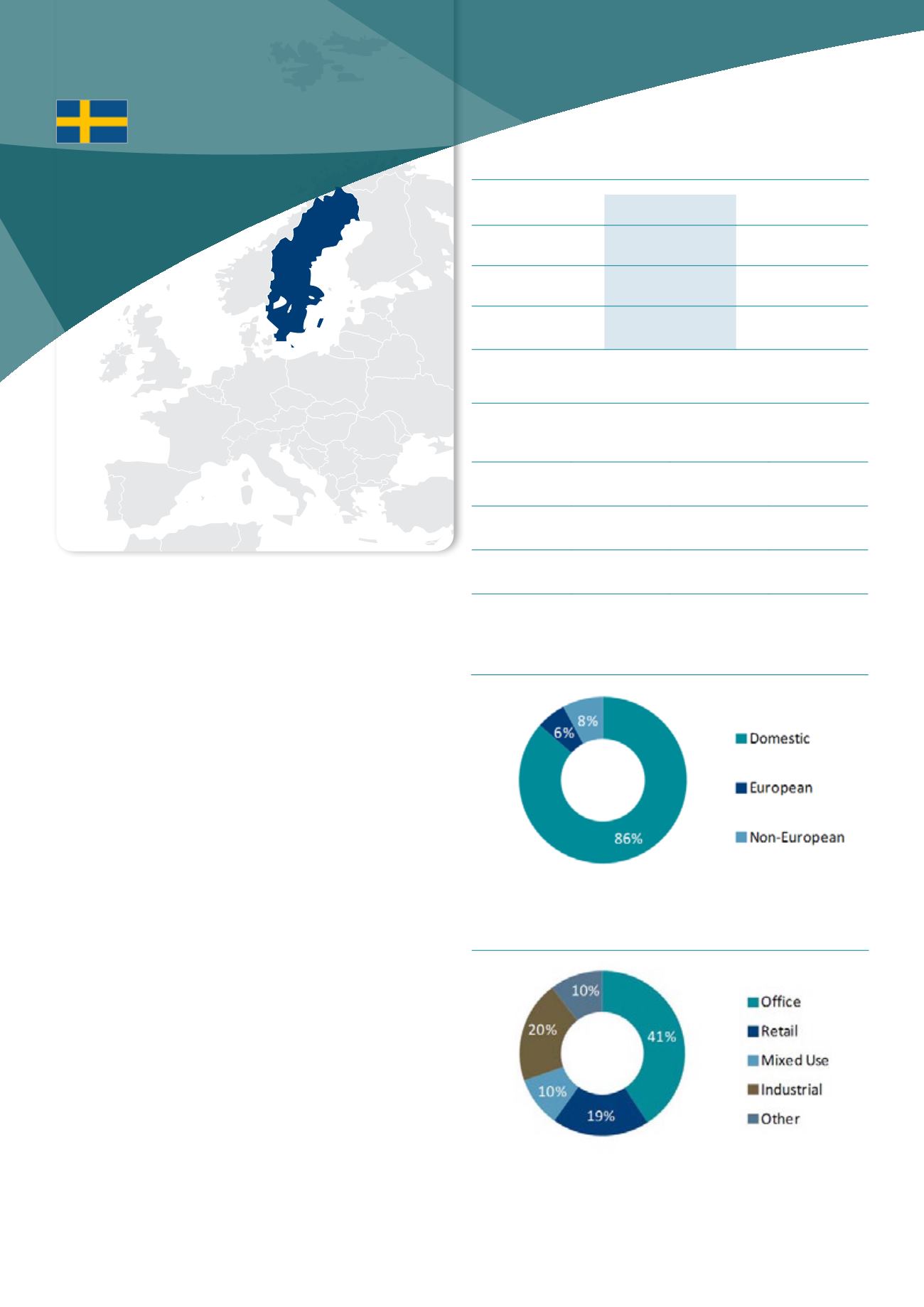

Investment activity by asset type, 2013

Source : DTZ Research

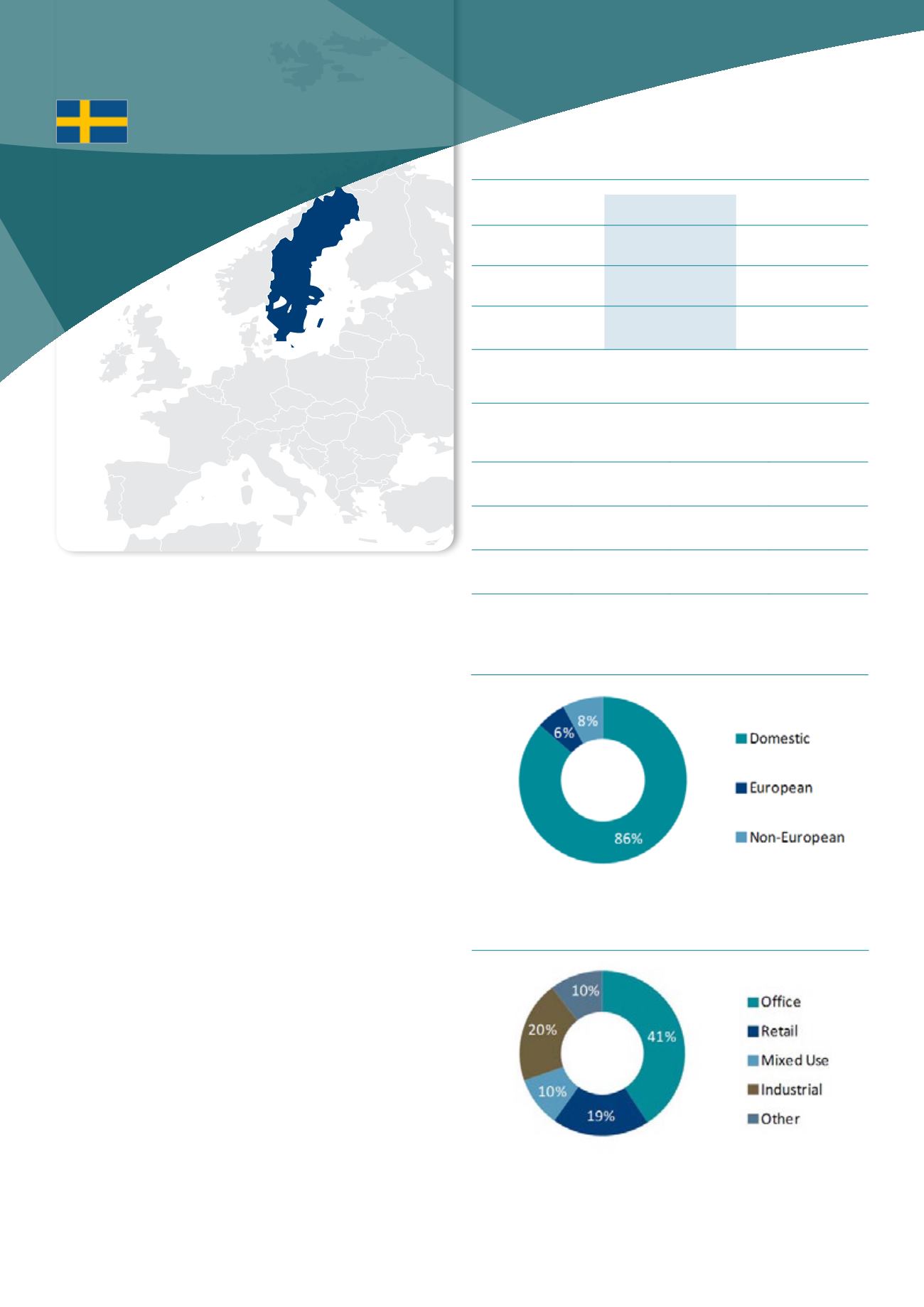

Investment activity by source of capital, 2013

Source : DTZ Research

Market pricing – Stockholm (Q4 2013)

office

Retail

Industrial

Current Yield 4.50% 4.50% 6.75%

Min/Max

(10y)

4.25-6.25% 4.25-6.25% 5.75-8.00%

Yield

definition

net initial yield

Source : DTZ Research

SWEDEn

* 2012 figures