52 |

Investor Guide to Europe 2014

The real estate market in Latvia is steadily

recovering from a complete standstill. Many

investors wish to benefit from low construction

prices and developers are maximizing the potential

of their assets. Tenants are optimizing their leases,

and in some sectors demand exceeds supply.

This unique situation can greatly benefit the

knowledgeable and the quick-witted.

The latvian market is still in its infancy and this is reflected

in the size of its stock. Despite being one of Europe’s smallest

markets it has been evolving rapidly over the past decade. We

expect this trend to continue and will offer opportunities for

investors.

latvia with its policy of conferring residency status through

investment in real estate attracts a lot of interest from

private individuals from Russia and CIS (Commonwealth of

Independent States) countries. Many concentrate their activity

towards the capital city of Riga. latvia is also on the active list

for institutional investors coming from within the Baltic region

itself (Estonia in particular) and from Scandinavian countries.

Asset transfer deals and share transfer deals are both

common practice, whereas institutional investment within the

country is limited to close-ended real estate funds managed by

asset management companies.

Debt funding for existing commercial assets is relatively easy

to obtain, whereas development opportunities have to be

backed-up with a clear asset development strategy. With the

recent accession to Eurozone, capital availability improved;

the capacity of developers is still under-exploited, whereas

government policy is generally favourable.

Market sizing

latvia

Europe

Invested stock*

(Total stock)

EUR 6bn

(EUR 14bn)

EUR 3,380bn

(EUR 8,150bn)

liquidity ratio*

(10y average)

1.3%

n/a

4.0%

(4.5%)

2013 volumes

(10y average)

EUR 0.1bn

n/a

EUR 139bn

(EUR 135bn)

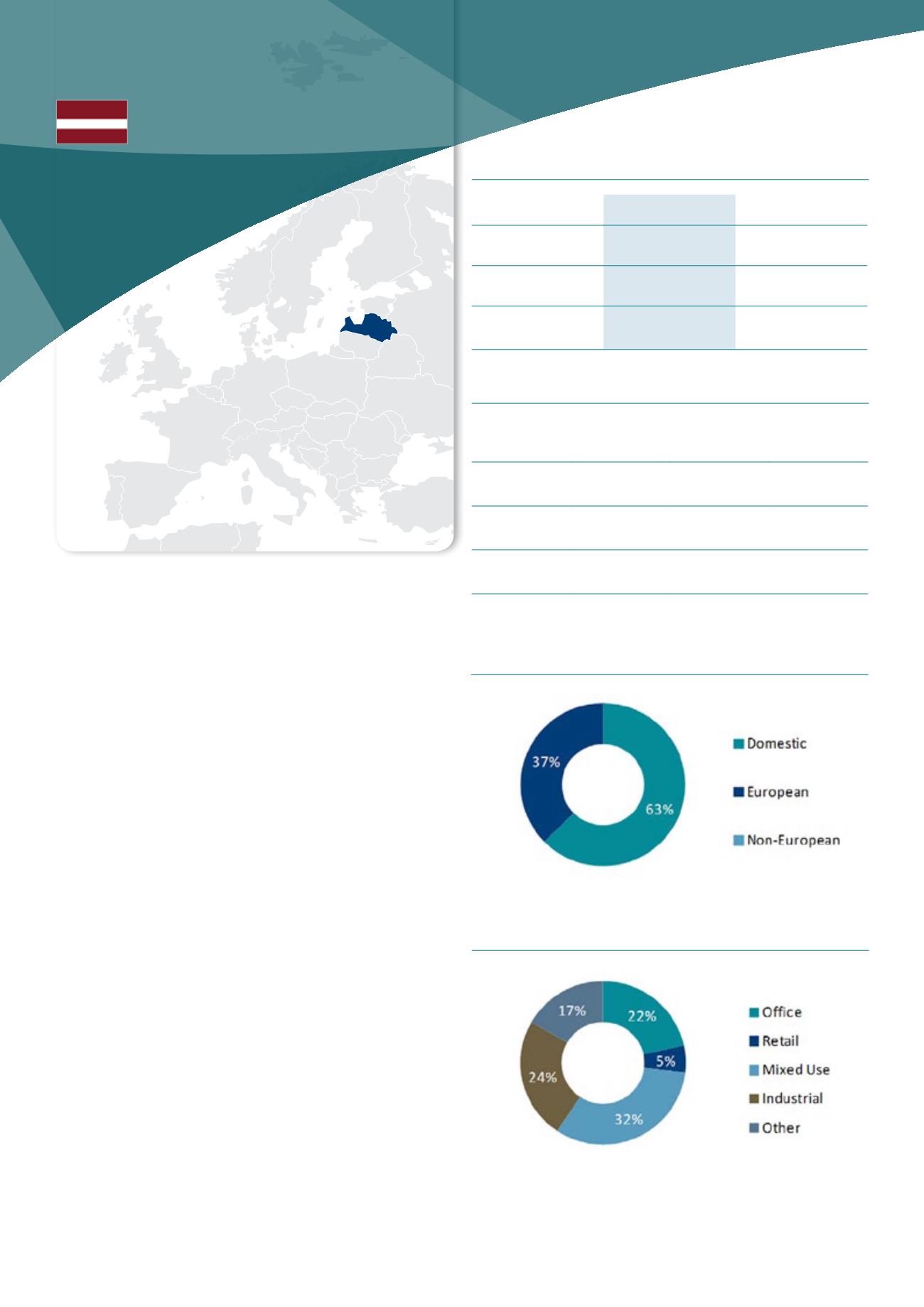

Investment activity by asset type, 2013

Source : DTZ Research

Investment activity by source of capital, 2013

Source : DTZ Research

Market pricing – Riga (Q4 2013)

office

Retail

Industrial

Current Yield 7.50% 7.00% 9.50%

Min/Max

(10y)

6.50-11.00% 6.00-11.00% 9.50-13.00%

Yield

definition

net initial yield

Source : DTZ Research

LaTvIa

* 2012 figures