46 |

Investor Guide to Europe 2014

Italy has the fifth largest investment market in

Europe by stock, with investment focussed on the

cities of Milan and Rome. as a G8 economy, Italy is

firmly established as major European destination for

global capital, as well as having its own substantial

real estate industry.

The market has been dominated by domestic investors,

representing close to two thirds of activity. Italy also attracts

capital from overseas, including global funds, Middle Eastern,

Uk and US capital. Growing overseas capital has helped

support the recovery in the Italian market.

outside of the core focus on office and retail assets, Italy also

sees demand for industrial and logistics premises around the

major conurbations. International business and resort hotels

are also keenly sought after.

Italy has a relatively small REIT industry, but a strong and

vibrant fund management business, particularly for unlisted

institutional funds. Preferential tax treatment also makes

unlisted funds a viable investment route for international

investors.

The Italian property market has historically shown relatively

stable performance, although latterly the property cycle

shows evidence of becoming longer and deeper. There are

active domestic and foreign lenders, although financing at

present is limited largely to income producing assets.

In recent years availability of debt has been restricted to core

assets at relatively low loan-to-values. over the past year we

have seen improvements to lending conditions. The majority

of debt remains sourced from traditional banks.

Market sizing

Italy

Europe

Invested stock*

(Total stock)

EUR 245bn

(EUR 730bn)

EUR 3,380bn

(EUR 8,150bn)

liquidity ratio*

(10y average)

1.4%

(2.0%)

4.0%

(4.5%)

2013 volumes

(10y average)

EUR 3.5bn

(EUR 5.0bn)

EUR 139bn

(EUR 135bn)

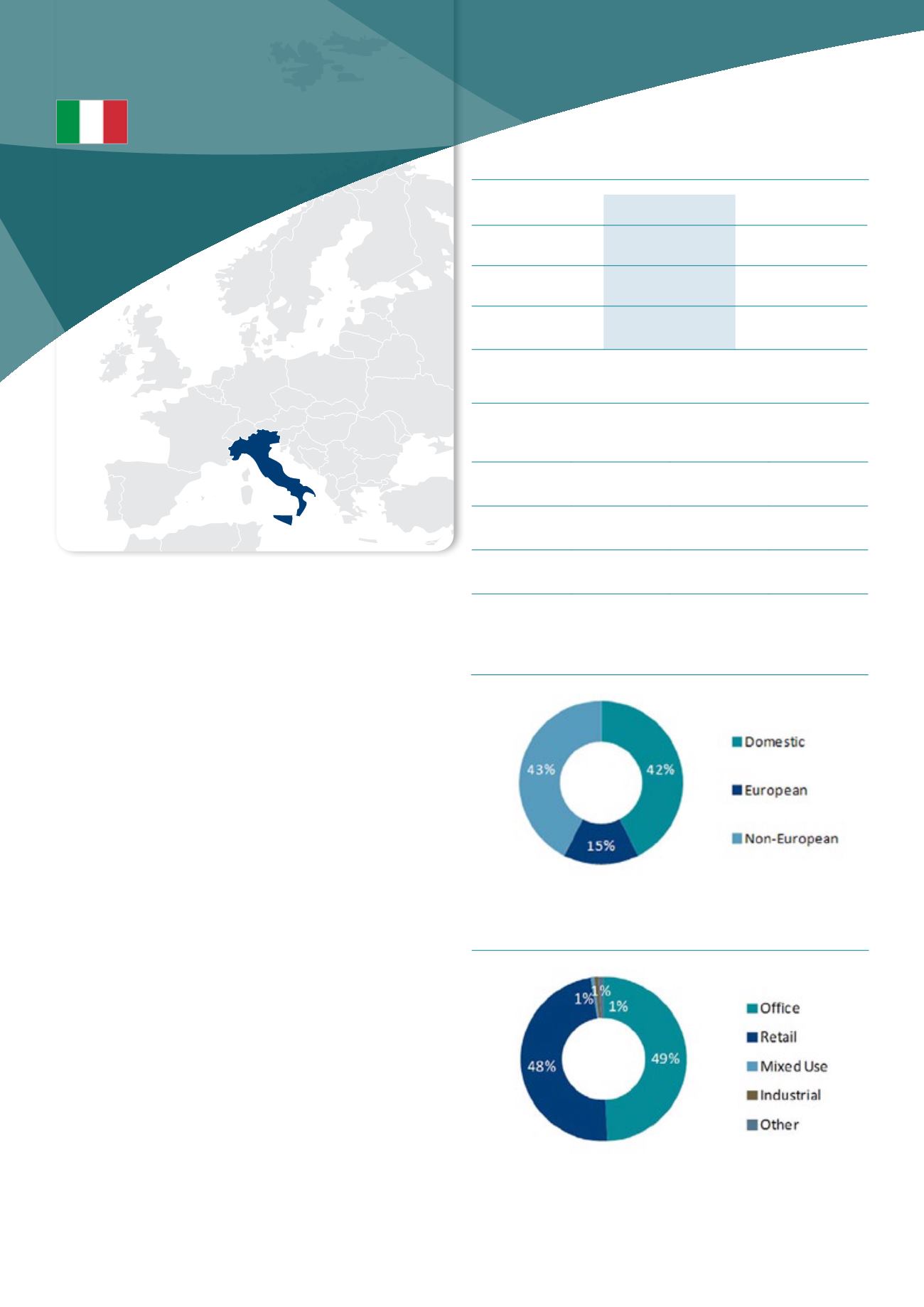

Investment activity by asset type, 2013

Source : DTZ Research

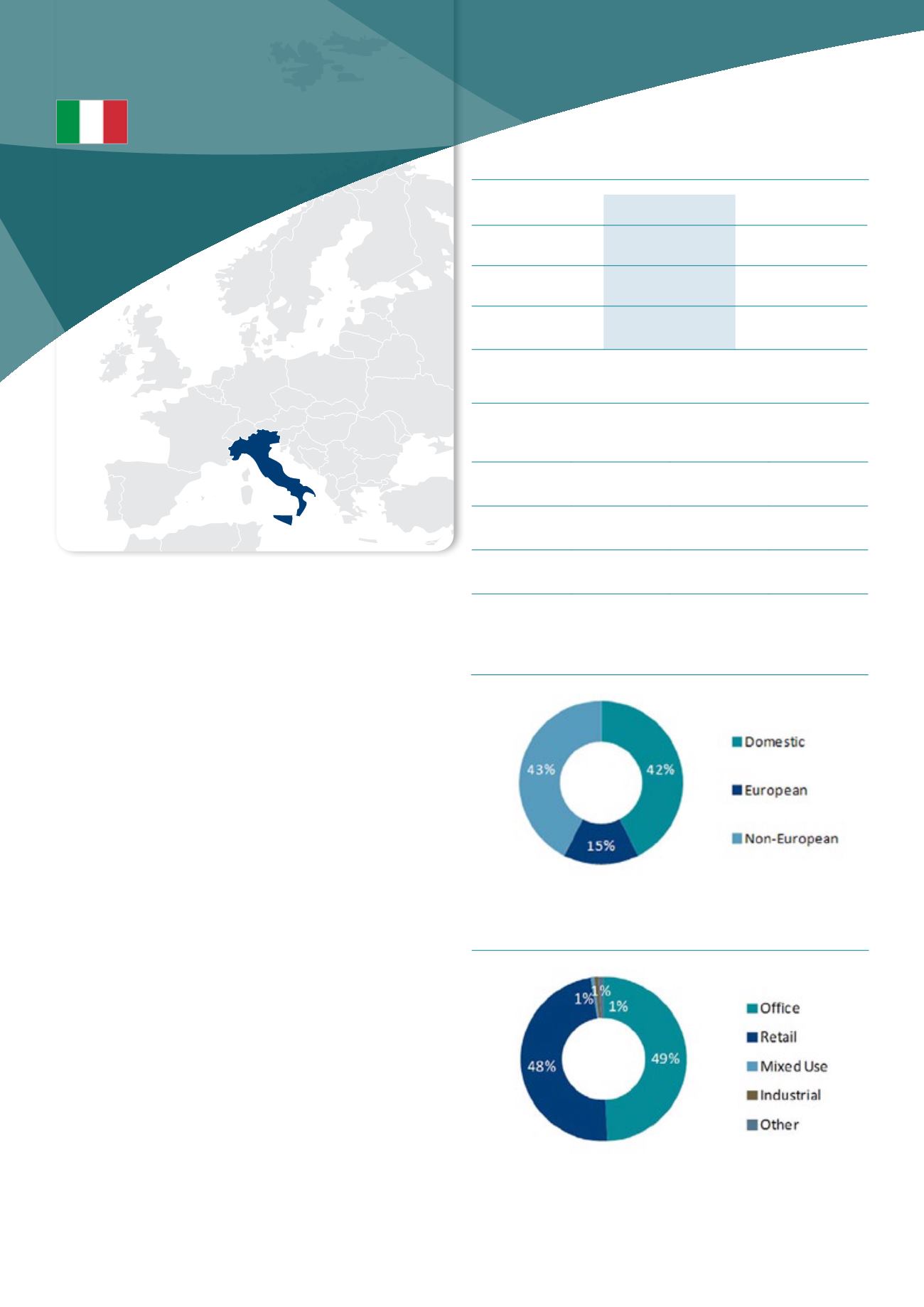

Investment activity by source of capital, 2013

Source : DTZ Research

Market pricing – Milan (Q4 2013)

office

Retail

Industrial

Current Yield 6.50% 5.25% 8.25%

Min/Max

(10y)

5.15-6.15% 5.00-6.00% 6.90-8.25%

Yield

definition

net initial yield

Source : DTZ Research

ITaLY

* 2012 figures