60 |

Investor Guide to Europe 2014

In terms of stock, Luxembourg is relatively small,

and this is reflected in the level of activity, with

volumes averaging less than EuR1bn per annum

over the last ten years. Its location in the heart of

Europe and its core sectors of activity does attract

investors from across Europe, mainly from Belgium,

france and Germany. as a result the country has

benefitted from above average levels of liquidity.

Private investors, unlisted funds, notably German funds, and

institutions are the most active players in the luxembourg

market. very little is traded or owned by listed companies.

Furthermore, investors from the Middle-East and Asia are

increasingly visible. Four of the most important Chinese banks

have now established operations in luxembourg.

offices represent the most sought-after asset class,

accounting for more than 79% of the total investment

volume in 2013, in line with the long run average. Benefiting

from dynamic letting activity and with important projects

in the pipeline, this asset class should continue to attract

investments, both in small and large volumes. Some mixed-

use projects are currently under development and could offer

alternative investment strategies as the competition for core

office assets is increasing. Retail and industrial/ logistics space

does trade, though volumes are typically lower.

Debt is readily available from traditional banks and German

Pfandbriefe banks. We do not see any real institutional activity

at present.

Market sizing

luxembourg

Europe

Invested stock*

(Total stock)

EUR 12bn

(EUR 25bn)

EUR 3,380bn

(EUR 8,150bn)

liquidity ratio*

(10y average)

3.5%

(7.0%)

4.0%

(4.5%)

2013 volumes

(10y average)

EUR 0.3bn

(EUR 0.9bn)

EUR 139bn

(EUR 135bn)

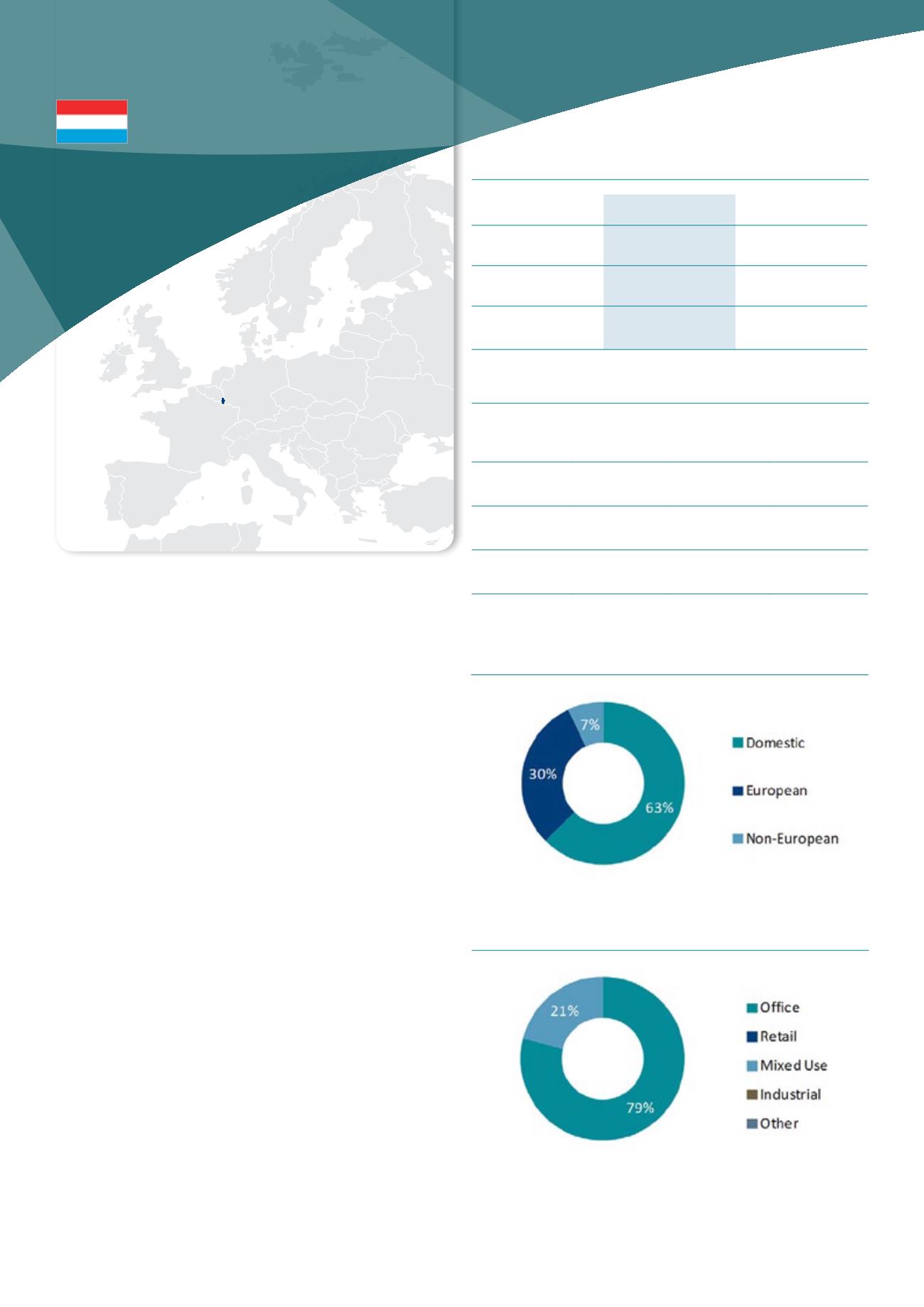

Investment activity by asset type, 2013

Source : DTZ Research

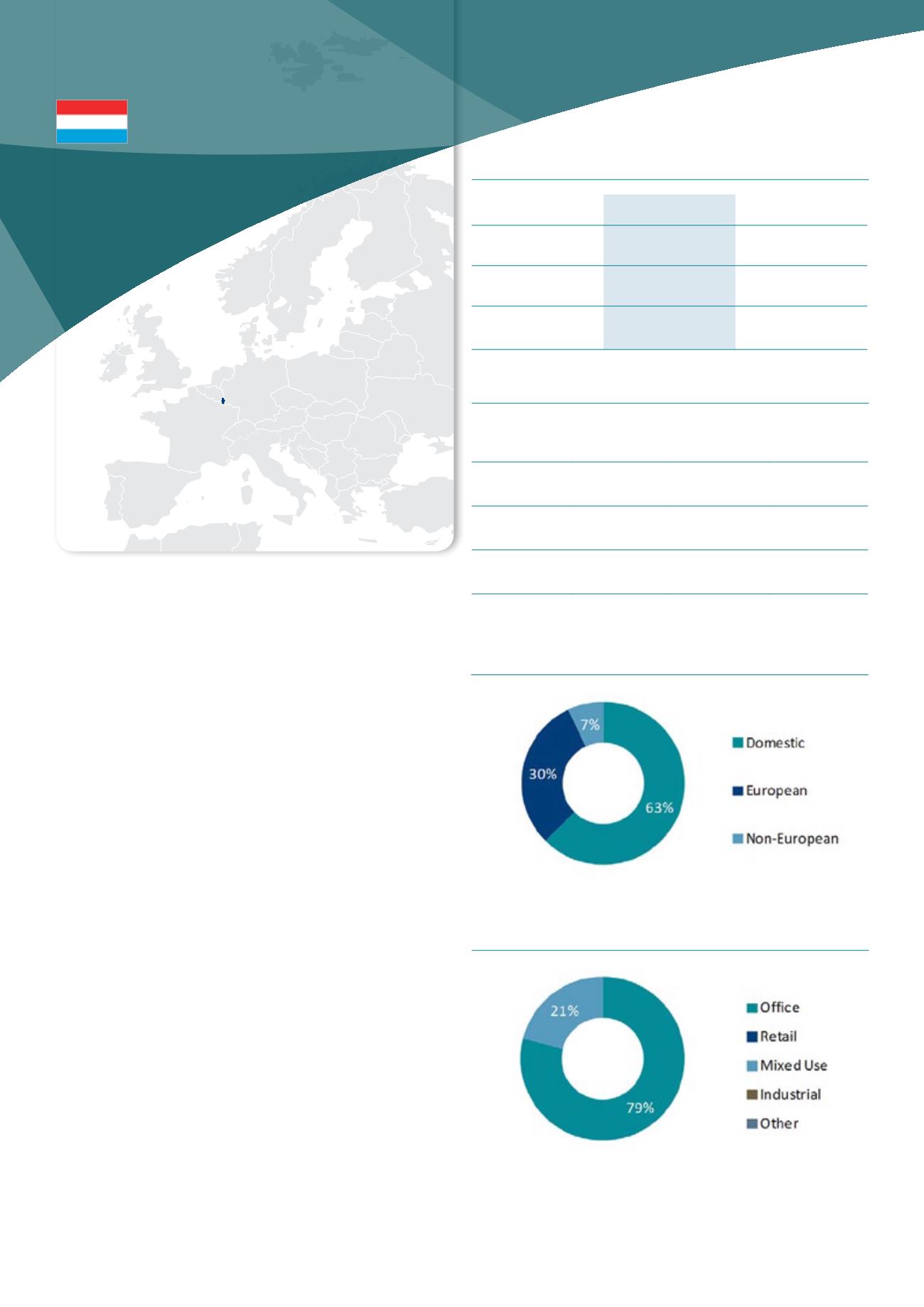

Investment activity by source of capital, 2013

Source : DTZ Research

Market pricing – luxembourg (Q4 2013)

office

Retail

Industrial

Current Yield

5.75% 5.25% 8.50%

Min/Max

(10y)

5.20-6.80% 5.25-6.00% 7.50-9.50%

Yield

definition

net initial yield

Source : DTZ Research

LuXEMBouRG

* 2012 figures