108 |

Investor Guide to Europe 2014

unITED

KInGDoM

The united-Kingdom is one of the largest

commercial real estate markets globally, and in

terms of invested stock is the largest across Europe.

The Uk attracts investors from across the Globe, with many

overseas investors concentrating their activity towards Central

london. Activity across the rest of the Uk is relatively lower

and focussed more towards the key cities and prime shopping

centres. Domestic activity across the Uk is strong and typically

represents over half of total activity. However over the last

decade we have consistently seen net sales from domestic

investors.

The Uk also has a well established investor base of its

own, with many institutional investors and listed property

companies. legislation to create REITs came into effect in

2007. The Uk also has a well established fund management

sector for both listed and unlisted funds, with many funds

domiciled offshore in Uk or foreign jurisdictions. The depth

and breadth to the investor base supports strong levels of

liquidity.

Given the maturity of the market it is relatively easy to

establish new funds in the Uk, subject to meeting regulatory

requirements.

Debt funding is also relatively easy to secure, especially for

core assets. The majority of funding is provided by both

domestic and overseas banks which are active in the Uk

market. In recent years there has been growing activity from

institutional lenders (predominantly insurers) and private and

institutional debt funds.

Market sizing

United kingdom

Europe

Invested stock*

(Total stock)

EUR 670bn

(EUR 940bn)

EUR 3,380bn

(EUR 8,150bn)

liquidity ratio*

(10y average)

8.0%

(7.5%)

4.0%

(4.5%)

2013 volumes

(10y average)

EUR 52bn

(EUR 50bn)

EUR 139bn

(EUR 135bn)

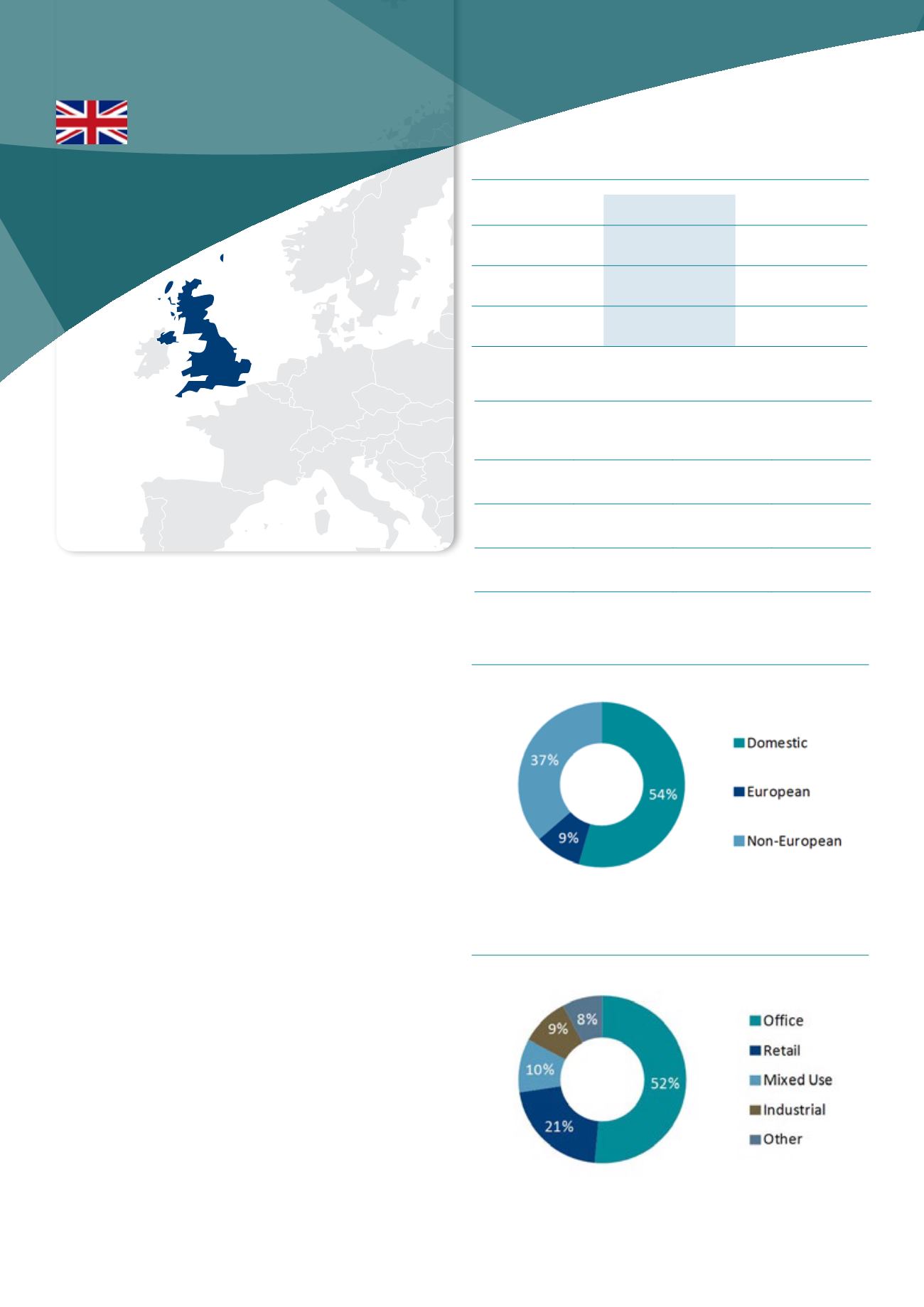

Investment activity by source of capital, 2013

Source : DTZ Research

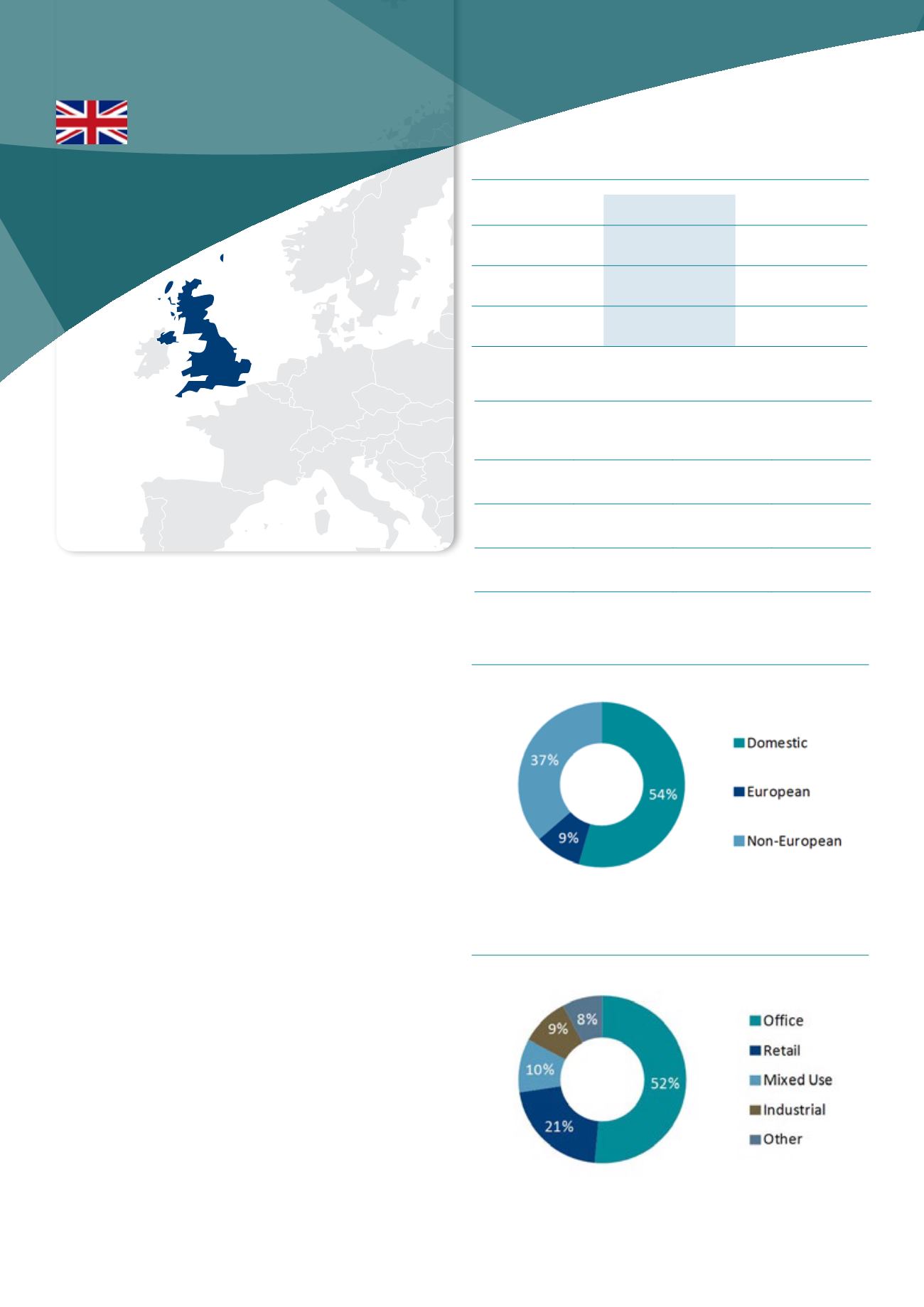

Investment activity by asset type, 2013

Source : DTZ Research

Market pricing – london (Q4 2013)

office

(City)

Retail

(West End)

Industrial

(Heathrow)

Current Yield

4.75% 3.50% 5.50%

Min/Max

(10y)

4.25-7.00% 3.50-5.75% 4.00-7.50%

Yield

definition

net initial yield

Source : DTZ Research

* 2012 figures