64 |

Investor Guide to Europe 2014

The netherlands is the sixth largest market in

Europe by stock. The centre of the Dutch economy

lies in the Randstad conurbation, which includes the

four largest cities of the netherlands - amsterdam,

Rotterdam, The Hague and utrecht. More than 50%

of the total office stock nationwide (49 million sq

m) is in this area. The so called Brabant region in

the south of the netherlands is very relevant for

production, manufacturing and logistics.

Amsterdam is the main focus for investors, accounting for

an average of 25% of the total investment volumes in the

netherlands over the last ten years. The areas around the

large train stations of Amsterdam (Center, Zuidas, Amstel,

Zuidoost) and Schiphol Airport are the prime investment

areas. Dutch and German investors dominate the prime areas

of the netherlands.

The netherlands has an active REIT market, with some REITs

having expanded their remit outside of the country. Dutch

institutional investors dominate the residential and retail

markets. Recently there have been signs that foreign investors

are entering these markets due to attractive yields in historical

and European perspectives.

The netherlands is attractive for logistics investors, with the

largest European seaport Rotterdam, Schiphol Airport and

excellent infrastructure leading into Europe. Demand for

logistics investments is therefore strong.

As lending by Dutch banks has been restricted recently, as

they restructure their balance sheets, opportunities for foreign

lenders have emerged. German banks and mezzanine funds

are entering the market.

Market sizing

netherlands

Europe

Invested stock*

(Total stock)

EUR 190bn

(EUR 285bn)

EUR 3,380bn

(EUR 8,150bn)

liquidity ratio*

(10y average)

2.0%

(3.0%)

4.0%

(4.5%)

2013 volumes

(10y average)

EUR 3.5bn

(EUR 5.0bn)

EUR 139bn

(EUR 135bn)

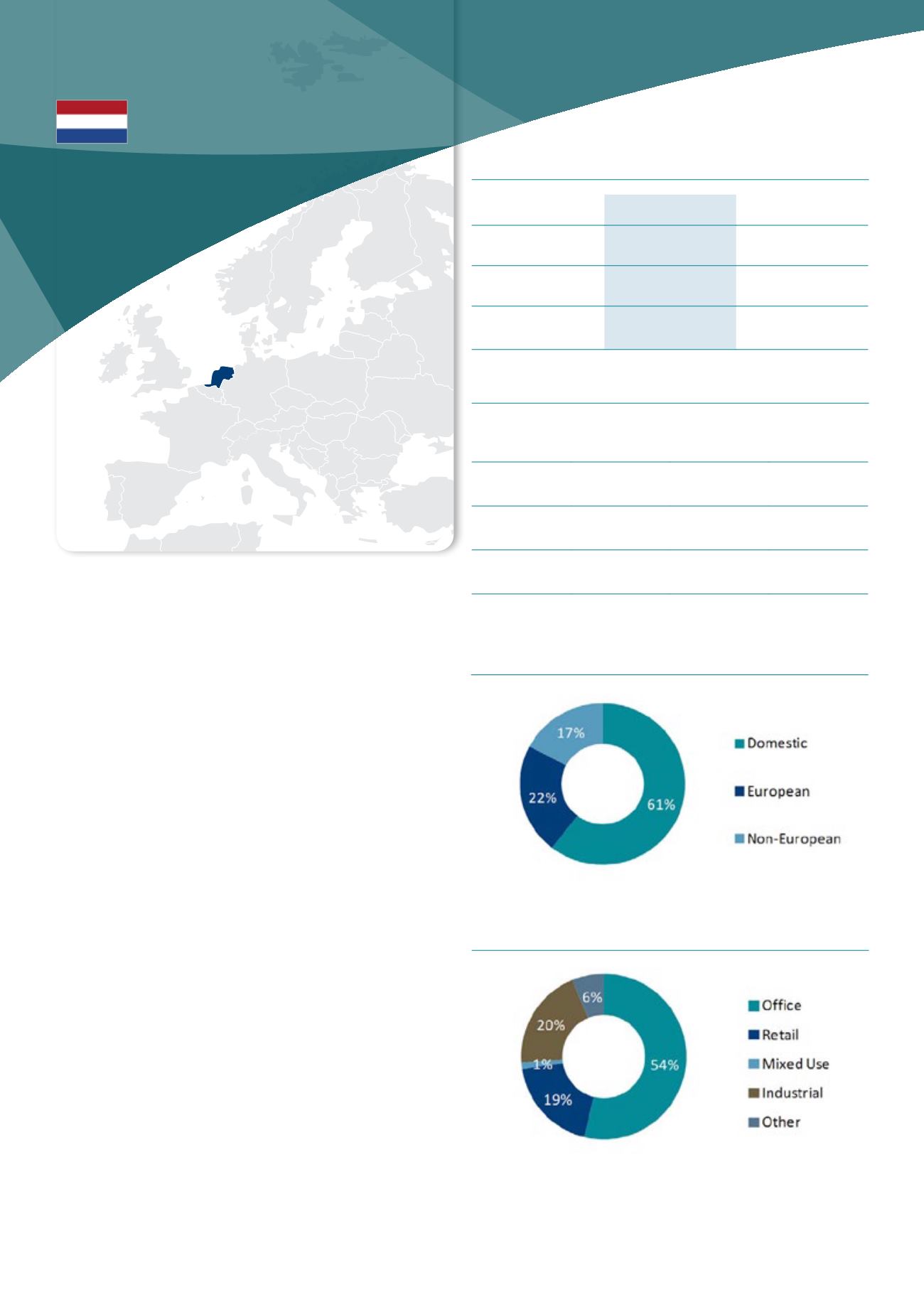

Investment activity by asset type, 2013

Source : DTZ Research

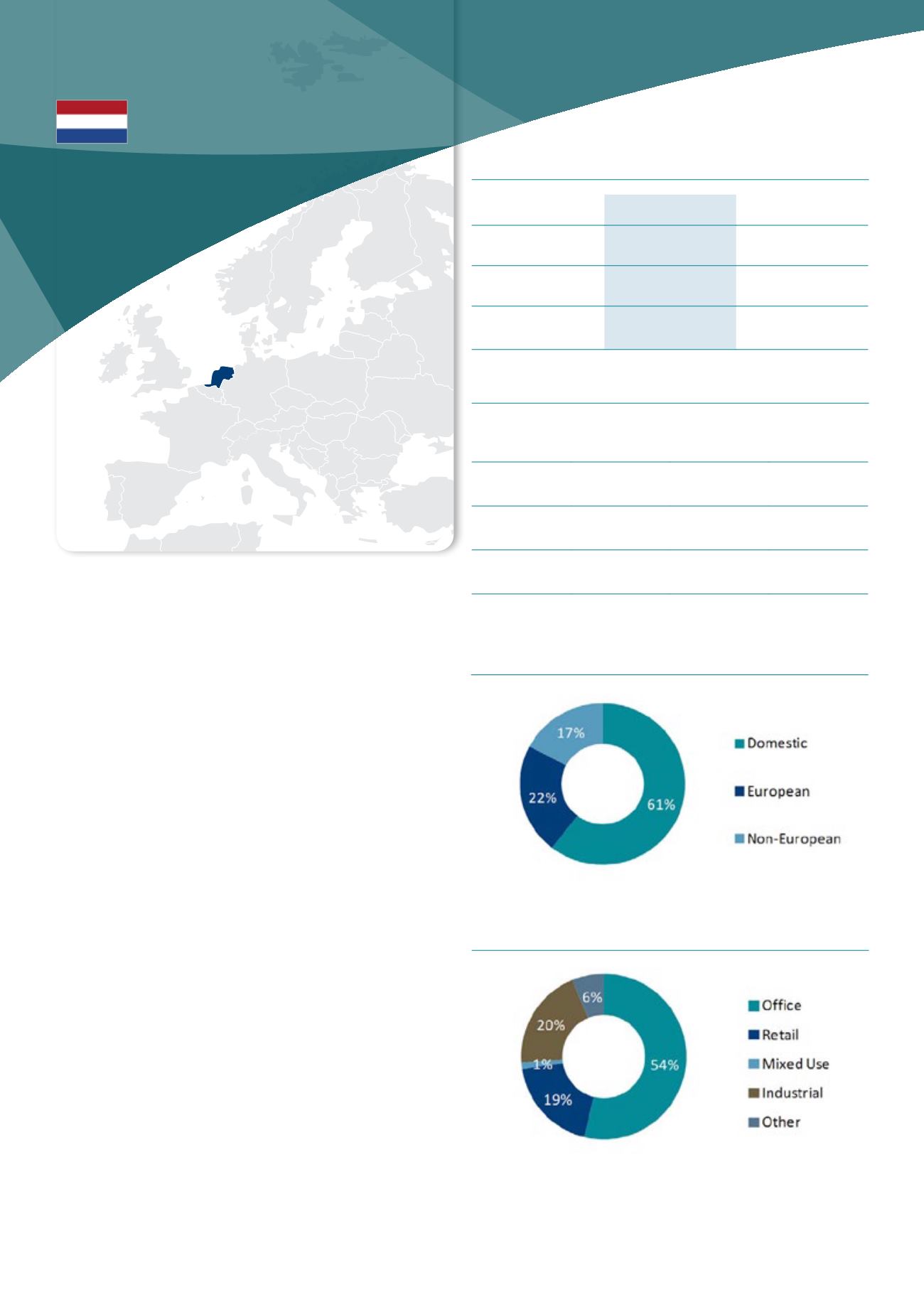

Investment activity by source of capital, 2013

Source : DTZ Research

Market pricing – Amsterdam/Rotterdam (Q4 2013)

office

(Amsterdam)

Retail

(Amsterdam)

Industrial

(Rotterdam)

Current Yield 5.80% 4.20% 7.25%

Min/Max

(10y)

5.25-6.75% 4.00-6.10% 7.20-8.20%

Yield

definition

Gross initial yield (Gross Rental Income/

Gross Market value)

Source : DTZ Research

nETHERLanDS

* 2012 figures