18 |

Investor Guide to Europe 2014

Denmark is the smallest country in the nordics in

terms of size, and as a result the Danish property

market does see below average levels of liquidity.

Domestic investors tend to be more dominant, as in

other nordic markets.

Foreign investment has been restricted to flows from other

European markets, notably from Sweden, norway, Germany,

the Uk and the netherlands. The most sought after assets are

residential, high street and shopping centre retail and office

properties in CBD and the Greater Copenhagen region.

Denmark also has a well established investor base of its own,

with many institutional investors, listed property companies as

well as some private investors.

The Danish market has lagged the recovery seen in other

nordic markets as investors and lenders have struggled with

a number of problematic assets in the wake of the financial

crisis. The situation is now starting to improve.

overall, debt funding is relatively easy to obtain and as

opposed to bank loans, mortgage loans (from mortgage banks)

are interminable for the lender as long as instalments are paid.

Moreover, in recent years there has been growing activity from

institutional lenders (predominantly insurers) and private and

institutional funds. Danish pension funds tend to stick with

new developments and have in many cases forward funded

projects in order to source deals at an early stage.

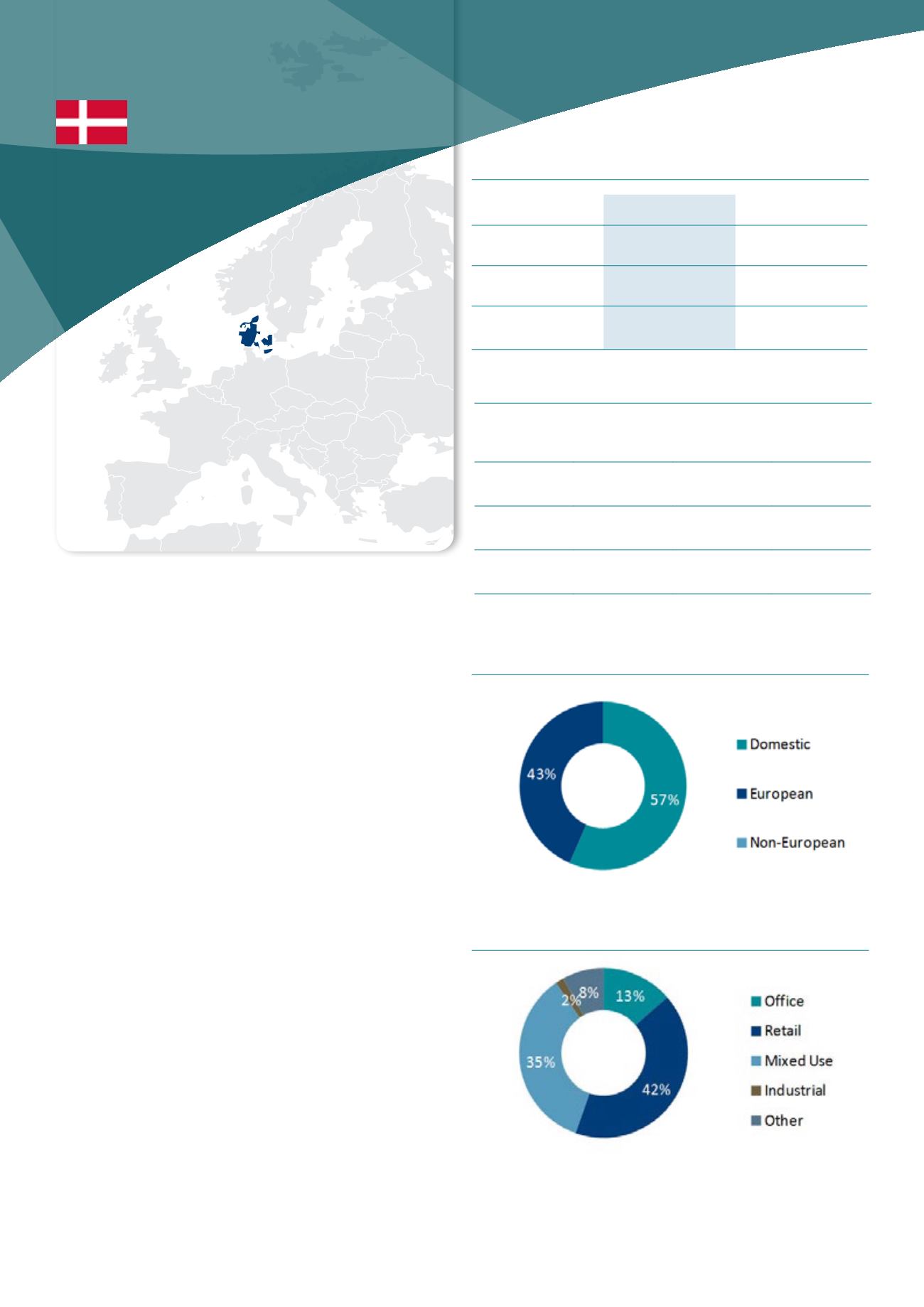

Market sizing

Denmark

Europe

Invested stock*

(Total stock)

EUR 40bn

(EUR 85bn)

EUR 3,380bn

(EUR 8,150bn)

liquidity ratio*

(10y average)

2.5%

(3.5%)

4.0%

(4.5%)

2013 volumes

(10y average)

EUR 1.0bn

(EUR 1.3bn)

EUR 139bn

(EUR 135bn)

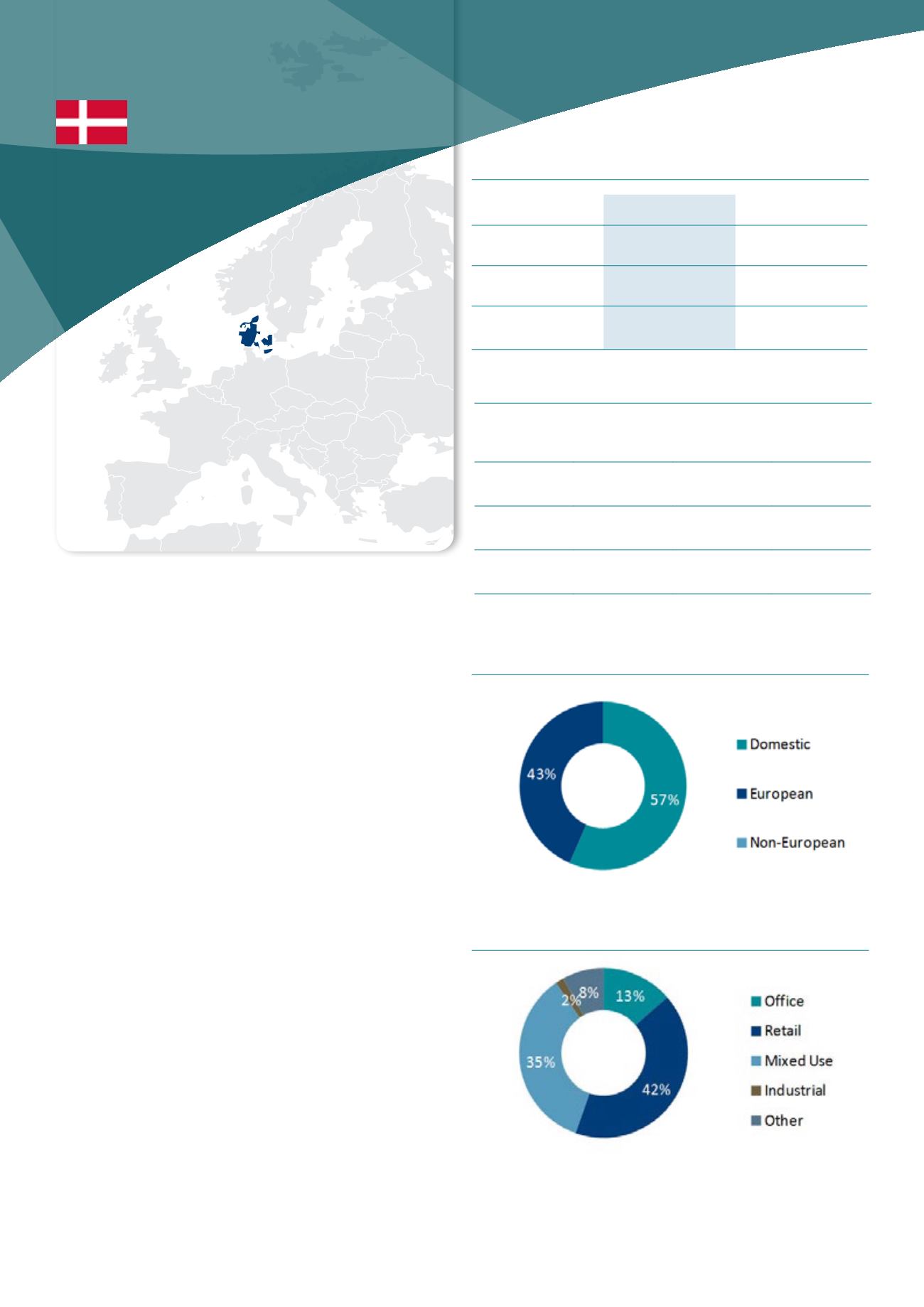

Investment activity by asset type, 2013

Source : DTZ Research

Investment activity by source of capital, 2013

Source : DTZ Research

Market pricing – Copenhagen (Q4 2013)

office

Retail

Industrial

Current Yield 5.00% 4.75 % 7.50%

Min/Max

(10y)

4.00-6.25% 3.25-5.75% 6.00-7.75%

Yield

definition

net initial yield

Source : DTZ Research

DEnMaRK

* 2012 figures