14 |

Investor Guide to Europe 2014

The Czech investment market has matured over the

past decade and is well rated due to its stability over

the recent years. When compared to other Central

and Eastern European (CEE) markets, the Czech

Republic sits alongside its neighbour, Poland, as the

most attractive markets in the region.

As with other CEE markets the Czech Republic has attracted

a relatively high share of cross border investment, although

in recent years domestic investors have increased their share,

with the market broadly balanced between domestic and

cross border activity. In particular the market has seen strong

activity from German and Austrian investors, together with

capital from the Uk and USA.

Whereby large institutional investors are targeting mainly

prime office or retail properties in Prague, domestic investors

are active across the entire country, as well as looking at

assets with value uplift potential. In recent years we have seen

an increase in private capital investments. The listed sector is

a very small part of the market.

The inflows of new investors are very encouraging and should

support further growth in the market. Although the focus

of activity has been towards offices and mixed schemes,

the logistics sector has seen some interest due to stronger

occupier demand.

Availability of debt is improving, with a mix of German,

Austrian and local lenders. Activity is currently focussed on

core assets.

Market sizing

Czech Republic

Europe

Invested stock*

(Total stock)

EUR 30bn

(EUR 115bn)

EUR 3,380bn

(EUR 8,150bn)

liquidity ratio*

(10y average)

3.5%

(5.5%)

4.0%

(4.5%)

2013 volumes

(10y average)

EUR 1.2bn

(EUR 1.2bn)

EUR 139bn

(EUR 135bn)

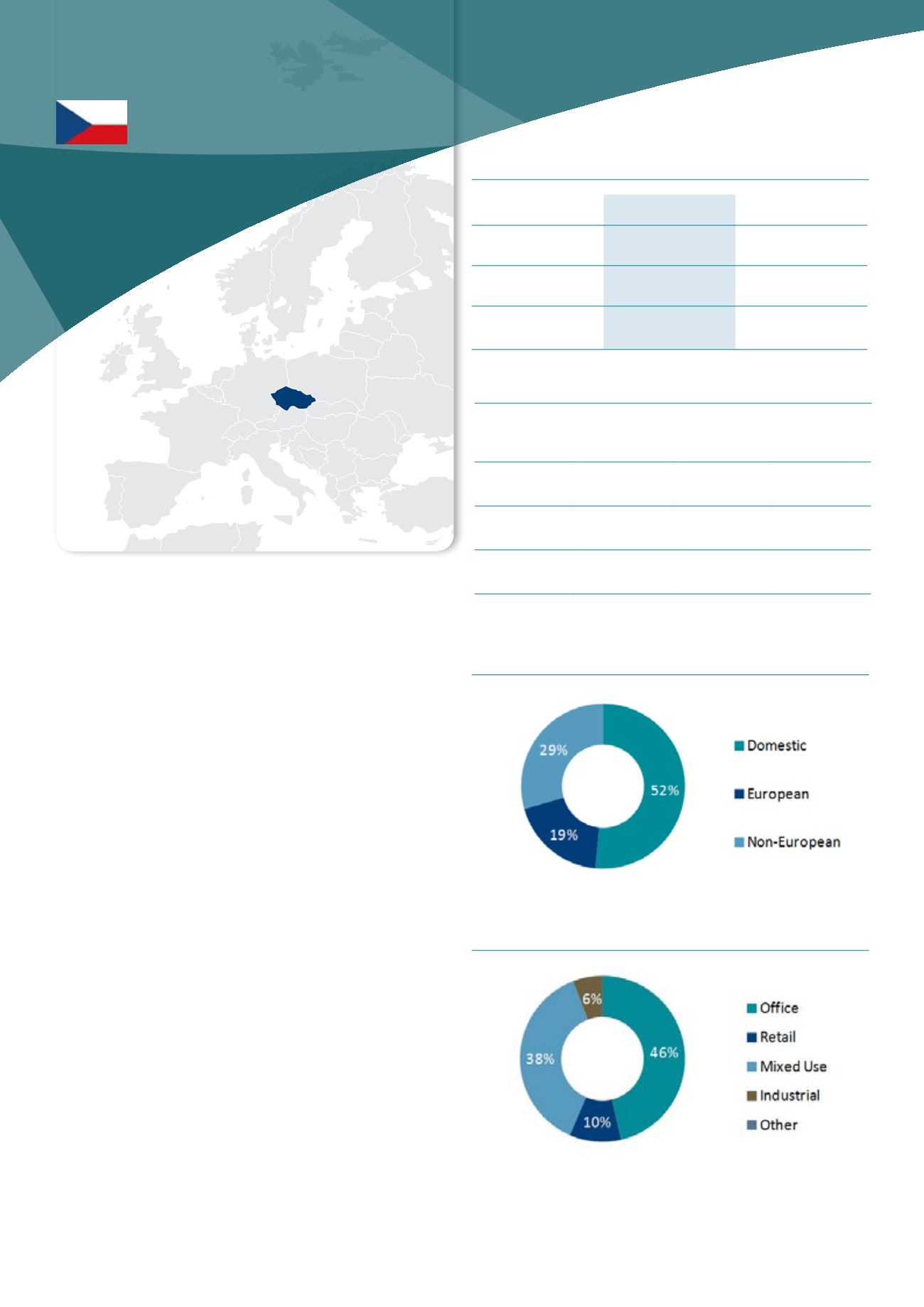

Investment activity by asset type, 2013

Source : DTZ Research

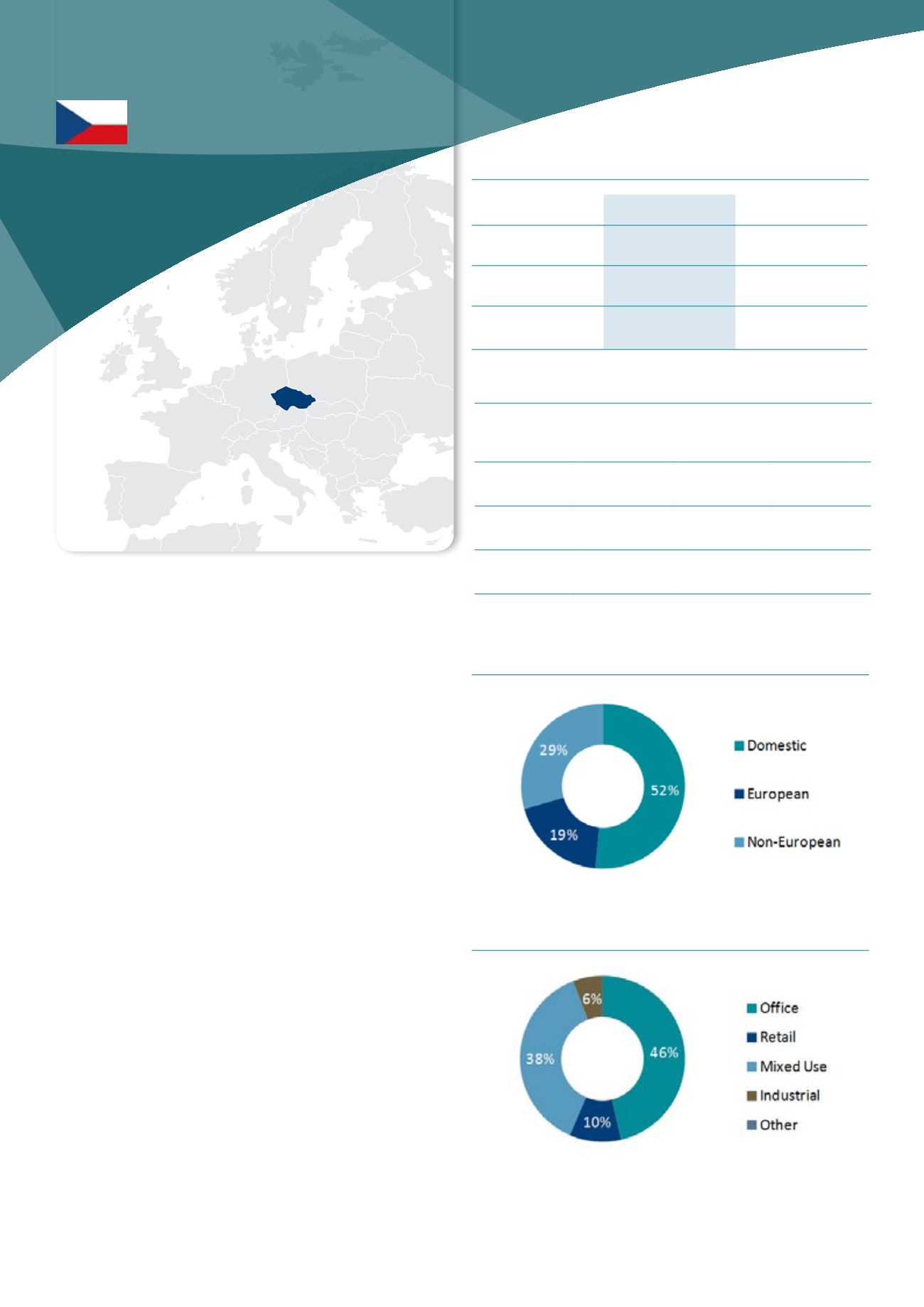

Investment activity by source of capital, 2013

Source : DTZ Research

Market pricing – Prague (Q4 2013)

office

Retail

Industrial

Current Yield 6.25% 6.00% 8.00%

Min/Max

(10y)

5.25%-

8.30%

5.50%-

8.00%

6.50%-

10.00%

Yield

definition

Gross initial yield

Source : DTZ Research

CZECH

REPuBLIC

* 2012 figures