Finland

Finland’s investment market is just over a third

the size of its neighbour Sweden. Despite being

smaller, it benefits from a well established

domestic investor base as well as growing

interest from overseas investors, especially

from Germany, Sweden, and the USA.

New domestic funds have entered the market,

including the first Finnish REIT. Due to the increasing

amount of new domestic funds and foreign investors

the liquidity of the

Finnish property market has improved and sits in

2014 well above the European average. The positive

trend concerning liquidity is expected to continue.

Measured by population growth, the Helsinki region is

one of the fastest growing areas in the Europe, which

enhances the attraction of the region. The Helsinki

Metropolitan Area (HMA) is the most important

property investment market, with a large part of the

transactions in 2014 occurring in this area.

The legal and taxation system is transparent and the

negotiation culture is straightforward. For example,

the legislation regulating lease agreements is rather

liberal, which gives parties the possibility to agree on

terms and conditions quite freely.

Although there have been economic challenges in the

Eurozone, Finland ranks high in The World Economic

Forum’s Global Competitiveness Index.

Market sizing

Finland

Europe

Invested stock

(Total stock)

EUR 48bn

(EUR 79bn)

EUR 3,335bn

(EUR 8,201bn)

Liquidity ratio

(10y average)

7.1%

(4.1%)

5.6%

(4.6%)

2014 volumes

(10y average)

EUR 3.7bn

(EUR 1.7bn)

EUR 187bn

(EUR 142bn)

Market pricing – Helsinki (Q4 2014)

Office

Retail

Industrial

Current Yield

4.75% 4.80%

6.75%

Min/Max (10y)

4.75-6.60% 4.80-6.50% 6.50-9.00%

Yield definition

Net initial yield

Source: DTZ Research

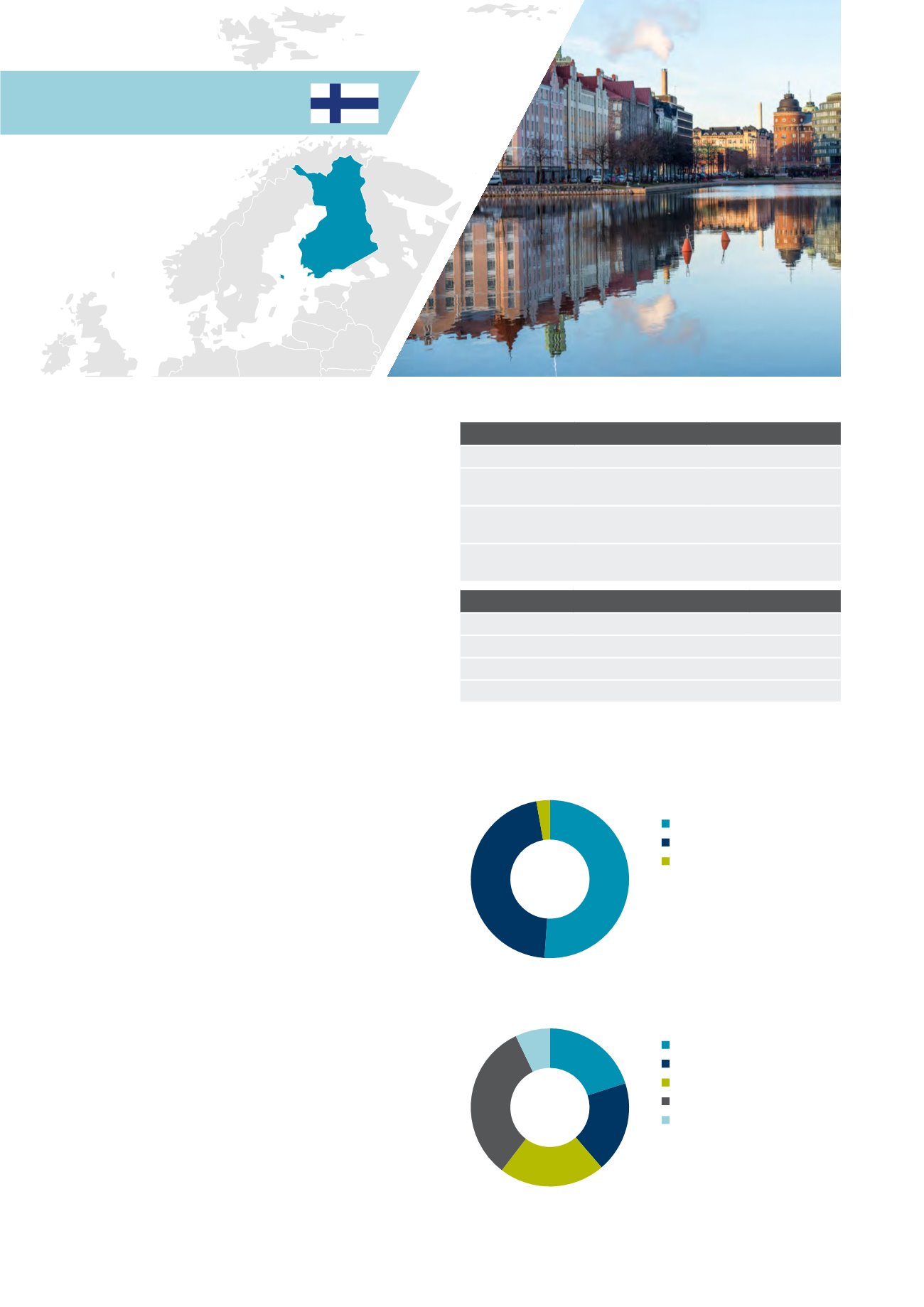

Investment activity by source of capital, 2014

Investment activity by asset type, 2014

Source: DTZ Research

Source: DTZ Research

51%

46%

3%

Domestic

Non-European

European

7%

20%

19%

22%

32%

Office

Mixed Use

Retail

Industrial

Other

32 Investors Guide to Europe 2015