16

How You Work: People, Places & Flexible Workspaces

03 Location

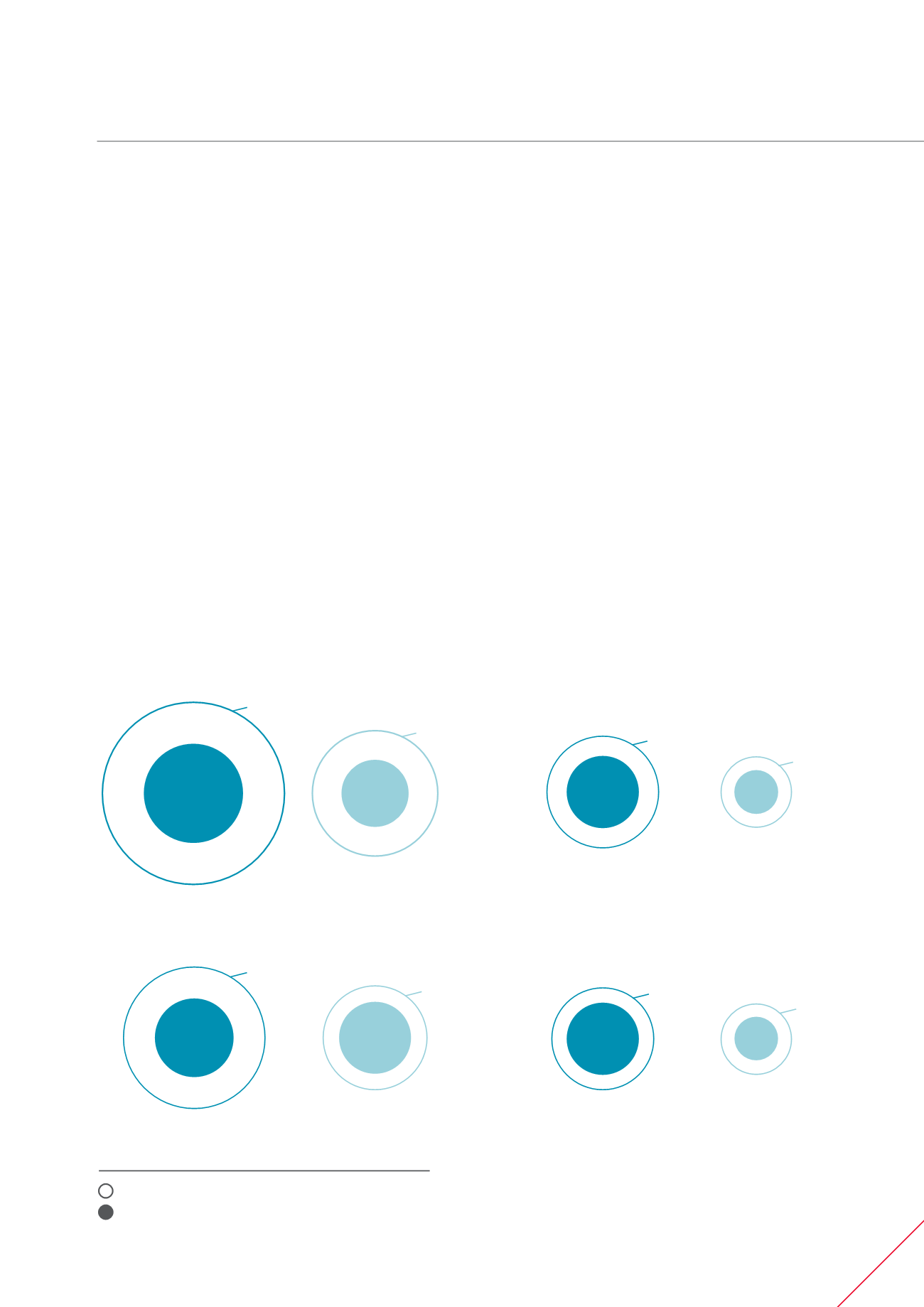

The GFC triggered a decline in construction globally by

5% in developed markets. The effects are still being

felt today despite renewed development activity and

market buoyancy. A subsequent shortage of Grade

A office supply in all global financial centres has sent

office rents in Central Business Districts (CBDs) soaring

by an average of 10.1% in the last two years. A 7%

rise in the number of commuters from the suburbs

into CBDs over the past decade has added a further

pressure on global city infrastructure. Though business

is enjoying a global resurgence, conventional offices

in high-demand locations have become prohibitively

expensive for most small companies.

Flexible Offices, however, have the potential to relieve

much of the strain. Remote working for employees

alleviates the requirement to commute to the CBD from

suburban areas. This could benefit both employees and

employers due to increased efficiency from reduced

travel time and lower rents in fringe locations.

9.6

k

7.2

k

2.7

k

2.5

k

6.7

k

6.7

k

16.5

k

6.2

k

London

The Cost Differential

New York

Shanghai

Berlin

9.9

k

3

k

8.8

k

19

k

30.5

k

3.1

k

8.9

k

1

1.2

k

Conventional Office Costs

Flexible Office Costs

Figures in US$ per annum per workstation (08/06/2015).

Costs are calculated by the

Cushman & Wakefield Global Occupier Metrics toolCBD

CBD

CBD

CBD

Fringe

Fringe

Fringe

Fringe