SHAUN BRODIE

Director, Head of China Strategy

Research and East China Research

+86 21 2208 0088

IT’S ALL ABOUT BIG FOOTPRINTS

FOR DOMESTIC COMPANIES

Local technology companies have preferred suburban locations

from the start. In addition, these companies generally purchase

land and build their offices. Sometimes domestic technology

companies will purchase en bloc property if they deem that

it is well suited to their needs. With respect to China national

level hi-tech companies, their properties tend to be big in scale.

For instance, Alibaba just moved into their new 100,000 sq m

group corporate headquarters in Hangzhou earlier last year and

Tencent are in the process of constructing their 160,000 sq m

headquarters in Shenzhen.

OUTLOOK

Things are continuing to look up for the technology sector in

China. According to a recent China market survey conducted by

DTZ Research, many of our hi-tech clients remain positive on the

outlook for business growth in the mainland China region. In fact,

around 30% of those surveyed said they were actually preparing

to make further investments in the mainland.

Finally, going forward, as more and more quality office projects

are completed and handed over in suburban areas, we expect

successive waves of decoupling and decentralisation by hi-tech

sector companies to take place in the mature Tier 1 city markets.

•

To work in offices which are more similar to those which they

are accustomed to working in other international markets,

such as in offices with large floorplate sizes and offices which

offer recreational facilities in or close by.

Big cities like Beijing and Shanghai now have a comprehensive

public transportation network which embraces many urban

fringe locations. In fact, Shanghai, at around 500km of metro

line track, now has the greatest length of metro tracks of any

city in the world. With this in mind, when technology companies

do decide to decentralise, they have less to worry about than in

the past with regard to staff leaving because of transportation

inaccessibility of new office locations.

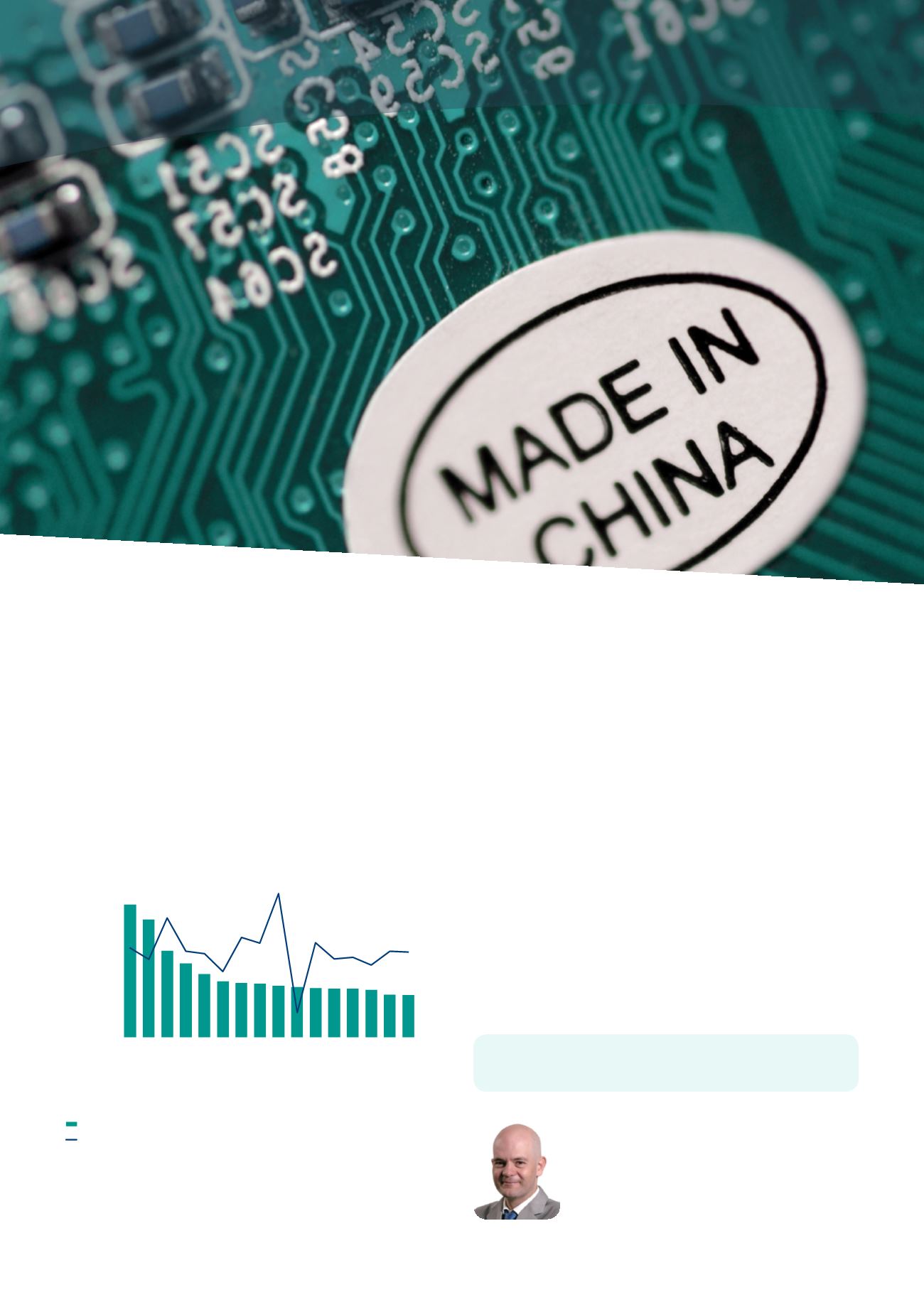

Source: DTZ Research

CHINA SELECTED CITIES — AVERAGE RENTAL AND

AVERAGE ANNUAL RENTAL GROWTH — Q4 2013

-15%

-10%

-5%

0%

5%

10%

15%

0.00

2.00

4.00

6.00

8.00

10.00

12.00

Beijing

Shanghai

Shenzhen

Guangzhou

Hangzhou

Chengdu

Nanjing

Tianjin

Wuhan

Xiamen

Shenyang

Changsha

Dalian

Qingdao

Xi’an

Chongqing

Average Rental (RMB/sq m/day)

Average Annual Rental Growth

RMB/sq m/day

DTZ | In Situ 29