30 |

Investor Guide to Europe 2014

france is the second largest market in Europe

after the uK, and is one of the top three markets

in Europe for investment activity, with around EuR

16bn invested per year on average over the last ten

years.

The investment market is focussed on the Greater Paris

Region and accounts for three quarters of the total investment

volume. But investors, finding the Greater Paris market too

competitive and relatively expensive, are also active in the

regional markets, with an average of EUR 3.5bn invested per

year.

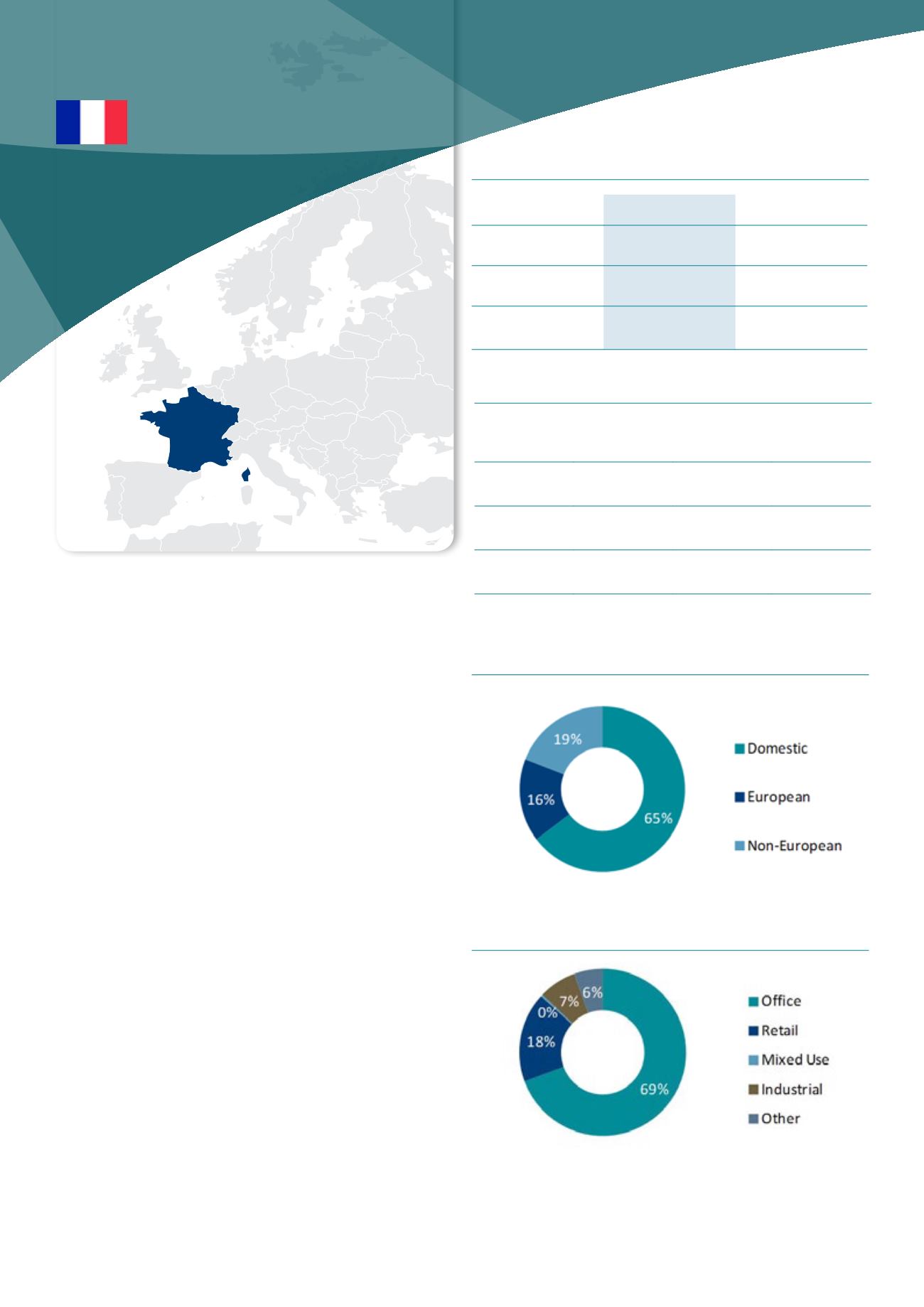

French investors dominate the market averaging over half

of investment each year, though their share was higher in

2013. German and north American investors are also active,

typically deploying over EUR1bn per annum, with Uk investors

slightly less.

The main players are the investments funds, followed by the

quoted companies. France has an active REIT market, which

was introduced at the end of 2003. Since 2009, the French

investment market has been dominated by equity players,

notably local SCPI’s and oPCI’s as well as German open-ended

funds.

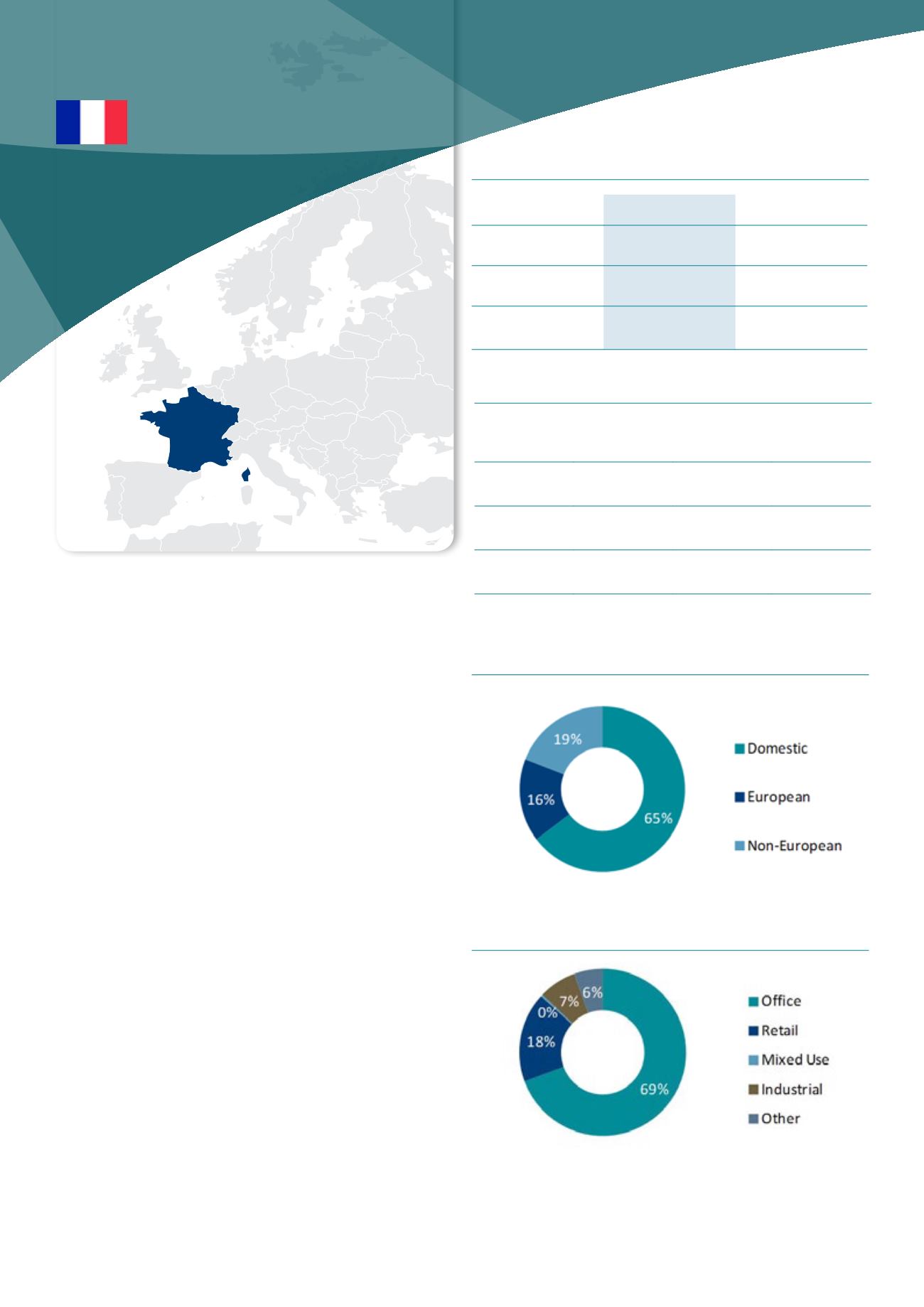

Thanks to the size of its office market (the biggest one in

Europe) the French market is dominated by office acquisitions,

with a long term average share of 69% of investments. Retail

assets have seen their market share increase since 2009,

representing 22% of commitments on average each year. Debt

is relatively easy to secure from traditional banks, as well as a

growing number of institutions and other debt funds.

Market sizing

France

Europe

Invested stock*

(Total stock)

EUR 535bn

(EUR 900bn)

EUR 3,380bn

(EUR 8,150bn)

liquidity ratio*

(10y average)

3.0%

(4.0%)

4.0%

(4.5%)

2013 volumes

(10y average)

EUR 17bn

(EUR 16bn)

EUR 139bn

(EUR 135bn)

Investment activity by asset type, 2013

Source : DTZ Research

Investment activity by source of capital, 2013

Source : DTZ Research

Market pricing – Paris (Q4 2013)

office

(CBD)

Retail

(City)

Industrial

(Paris Region)

Current Yield 4.00% 4.00% 7.35%

Min/Max

(10y)

3.75-6.00% 4.00-6.00% 5.90-8.50%

Yield

definition

net initial yield

Source : DTZ Research

fRanCE

* 2012 figures